Printable W Form

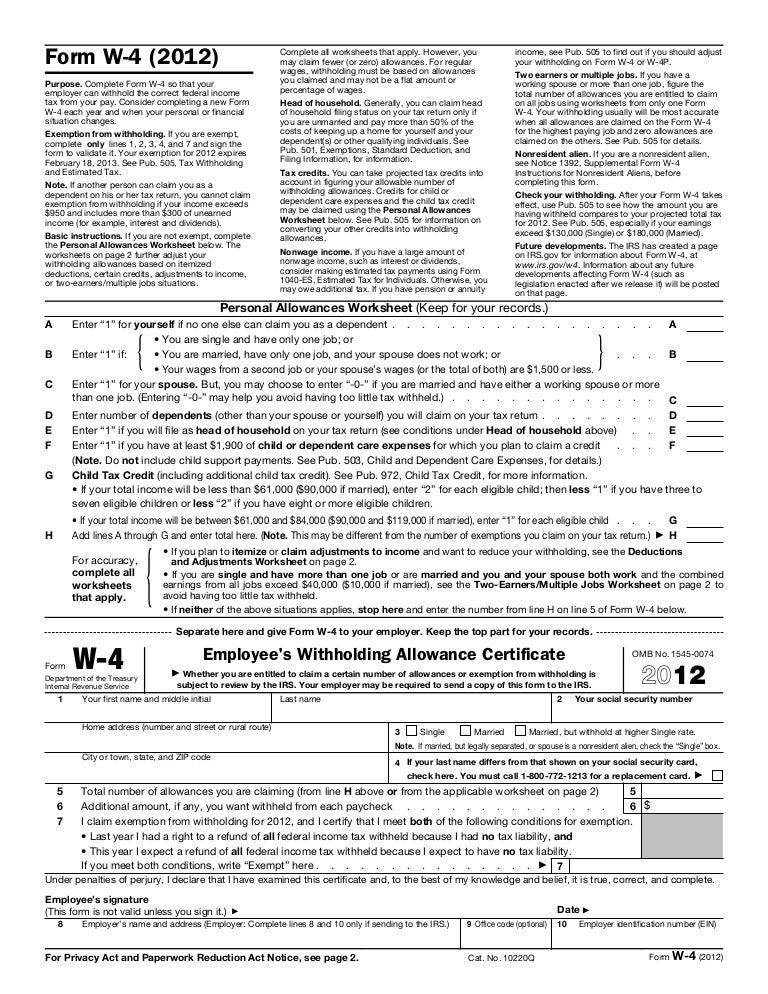

Form w 4 2020 employees withholding certificate department of the treasury internal revenue service complete form w 4 so that your employer can withhold the correct federal income tax from your pay.

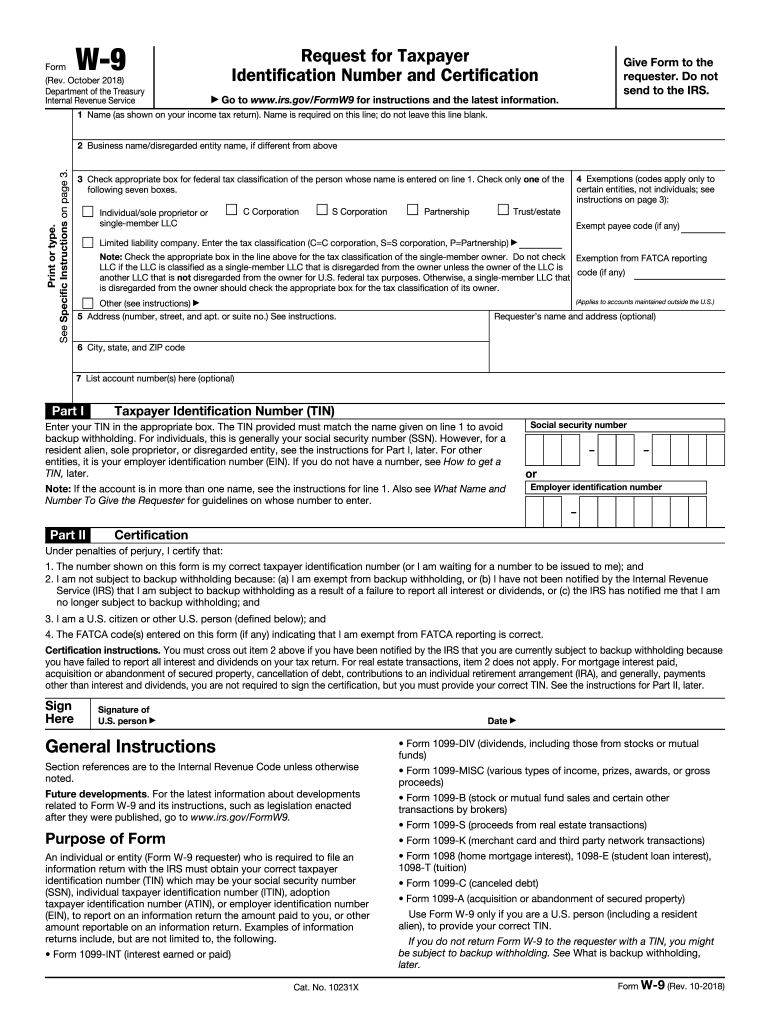

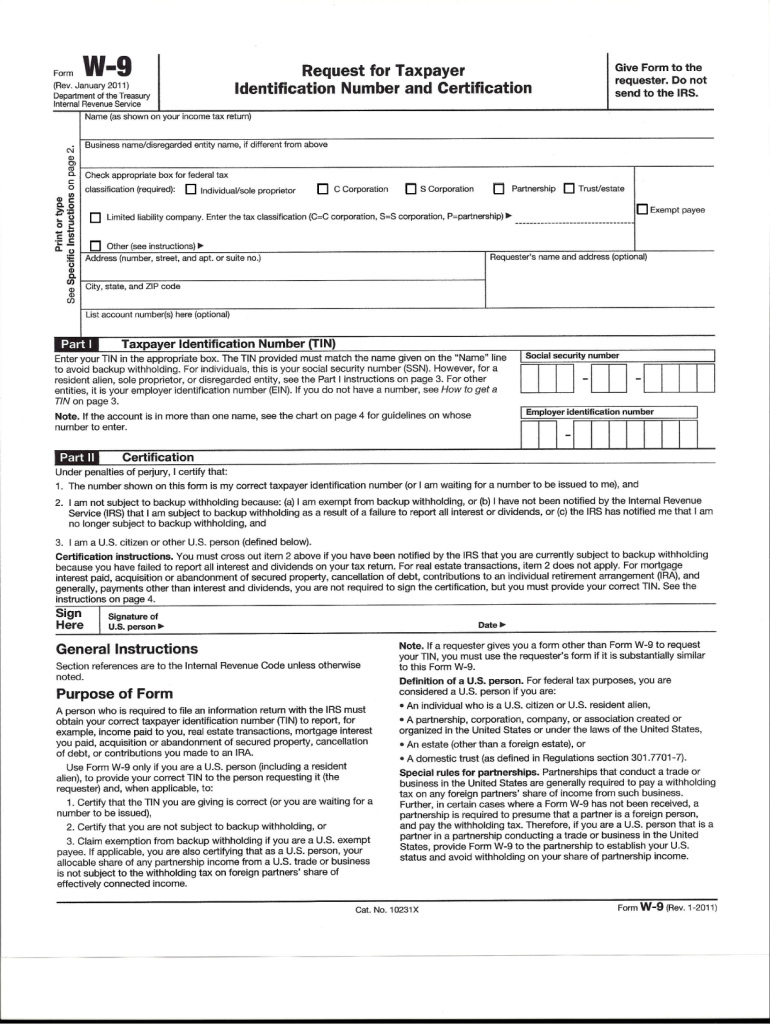

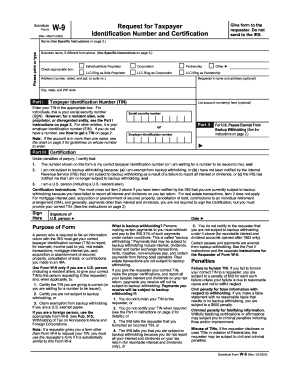

Printable w form. 1 2011 page 2 the person who gives form w 9 to the partnership for purposes of establishing its us. Download printable w 9 form 2020. Employer identification number or taxpayer identification number. Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the united states is in the following cases.

Request for taxpayer identification number and certification 1018 10242018 inst w 9. Create a printable w 9 form 2019 2020 in minutes. Withholding certificate for pension or annuity payments 2019 02042019 form w 4p. Irs w 4 form 2020 printable.

Blank w 9 form 2020 printable. Instead use the appropriate form w 8 or form 8233 see pub. Withholding certificate for pension or annuity payments 2018 02052019 form w 4s. There is likely going to be a new form for 2020 but it appears to be more detailed and complex as it takes more time than expected and it is something unusual for the irs.

Instructions for the requestor of form w 9 request for taxpayer identification number and certification 1018 10292018 form w 9 sp solicitud y certificacion del numero de identificacion del contribuyente. If youre self employed and running your own business you will need. How to fill out a w9 blank online for a business freelancers independent contractor on profit etc. Nonresident alien who becomes a resident alien.

Whichever irs form you need the agency offers them for free without any login or charge at all from its website. Generally only a nonresident alien individual may use the terms of a tax treaty to reduce. The internal revenue service or any other agency of the federal government is responsible for providing you the documents and forms that you need to fulfill your duties. Once you print and start to fill out the w 9 form there are a couple of lines you need to be careful that are crucial for the irs.

The irs works with the treasury department on form w 4 employees withholding allowance certificate whenever it needs an update. Participating foreign financial institution to report all united states 515 withholding of tax on nonresident aliens and foreign entities. The complete form w 4 is a four page form but the only part that matters is the bottom of the first page which you will have to separate and give it to your employer.