Printable W 4 Form For 2019

You can print or submit the form to irs online in minutes.

Printable w 4 form for 2019. Follow given instructions to calculate withholdings correctly. You can easily sign edit and save them. Enhance your productivity with powerful service. Print or instantly send your documents.

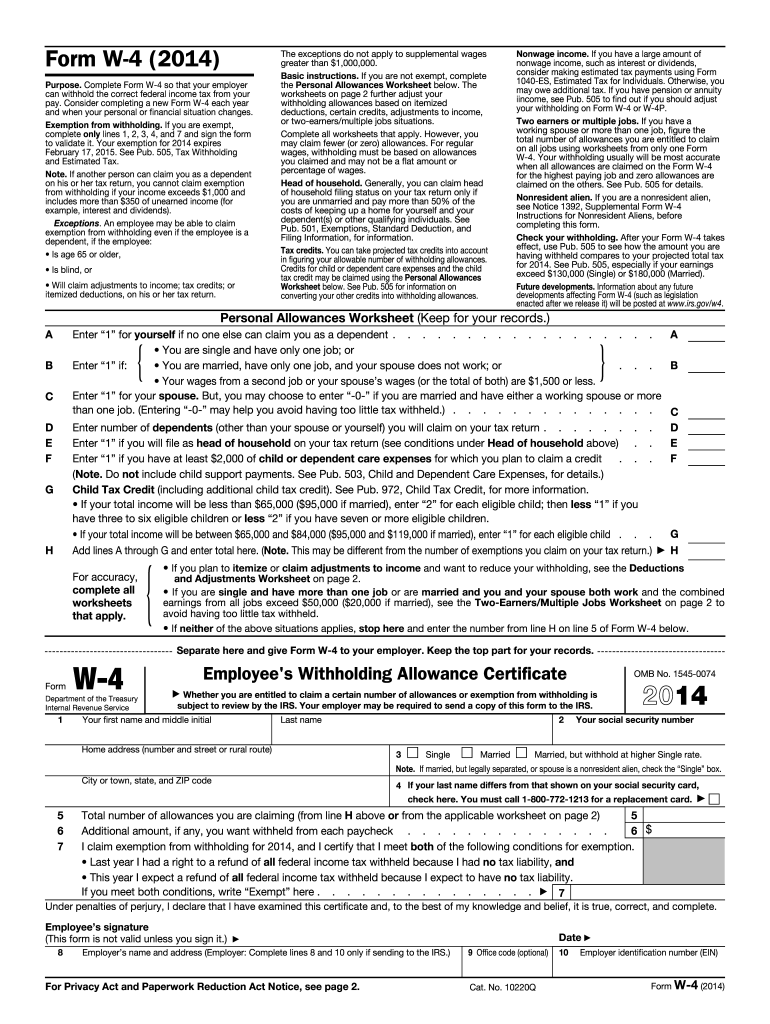

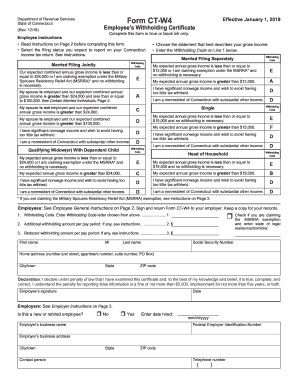

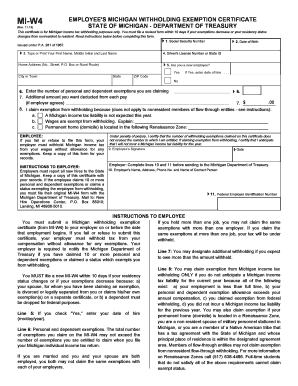

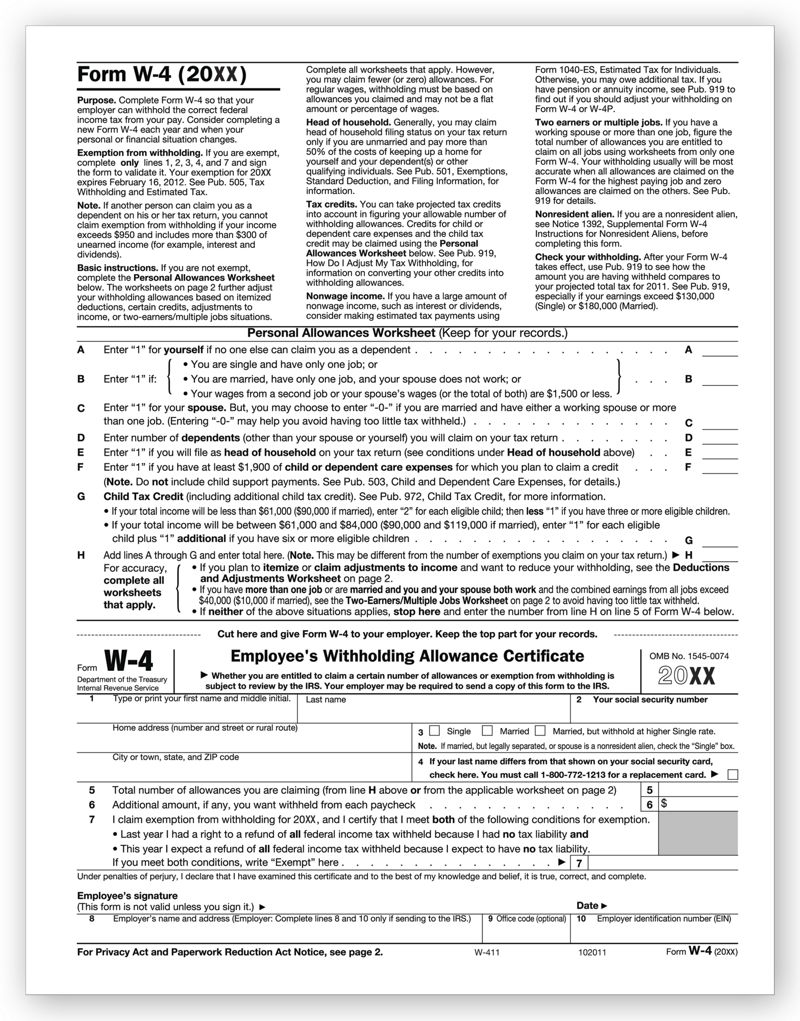

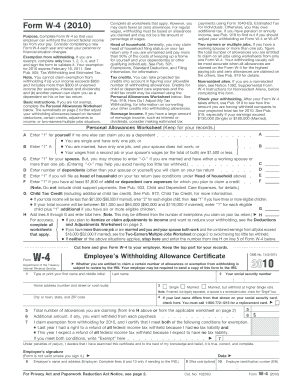

Form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Fill out forms electronically working with pdf or word format. Create and complete a w 4 form 2019 using our pdf templates. Forms w 4 filed for all other jobs.

Form w 4 2020 employees withholding certificate. Use this form to ask payers to withhold federal income tax from certain government payments. Make them reusable by generating templates add and fill out fillable fields. Save documents on your computer or mobile device.

Withholding certificate for pension or annuity payments 2018 02052019 form w 4s. The current 2019 version of the form w 4 is similar to last years 2018 version. Line 16 on your 2019 form 1040 or 1040 sr is zero or less than the sum of lines 18a 18b and 18c or 2 you were not required to file a return because your income was below the filing threshold for your correct filing status. W 4 form 2019 2020.

Request for federal income tax withholding from sick pay 2018 01032019 form w 4s. Approve forms using a lawful electronic signature and share them through email fax or print them out. Easily fill out your blank edit and download it. We offer detailed instructions for the correct federal income tax withholdings.

Information about form w 4 employees withholding certificate including recent updates related forms and instructions on how to file. Get printable w 4 form to file in 2019. Updated 5312019 the treasury department and the irs are working to incorporate changes into the form w 4 employees withholding allowance certificate for 2020. Create and fill out pdf blanks online.

Information about form w 4v voluntary withholding request including recent updates related forms and instructions on how to file. For example if you earn 60000 per year and your spouse earns 20000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your form w 4 and your spouse should enter zero 0 on lines 5 and 6 of his or her form w 4.