Printable 501c3 Form

Before viewing it please see the important update information below.

Printable 501c3 form. The foundation group provides services for irs 501c3 501c3 tax exemption applications starting a nonprofit form 990 and statefederal compliance. See application process for a step by step review of what an organization needs to know and to. We handle all the paperwork and do not require any specific client obligation. When you file through their website they keep a copy of your tax exempt form on your account so that you can access and print it at any time.

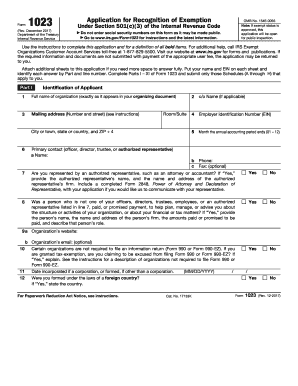

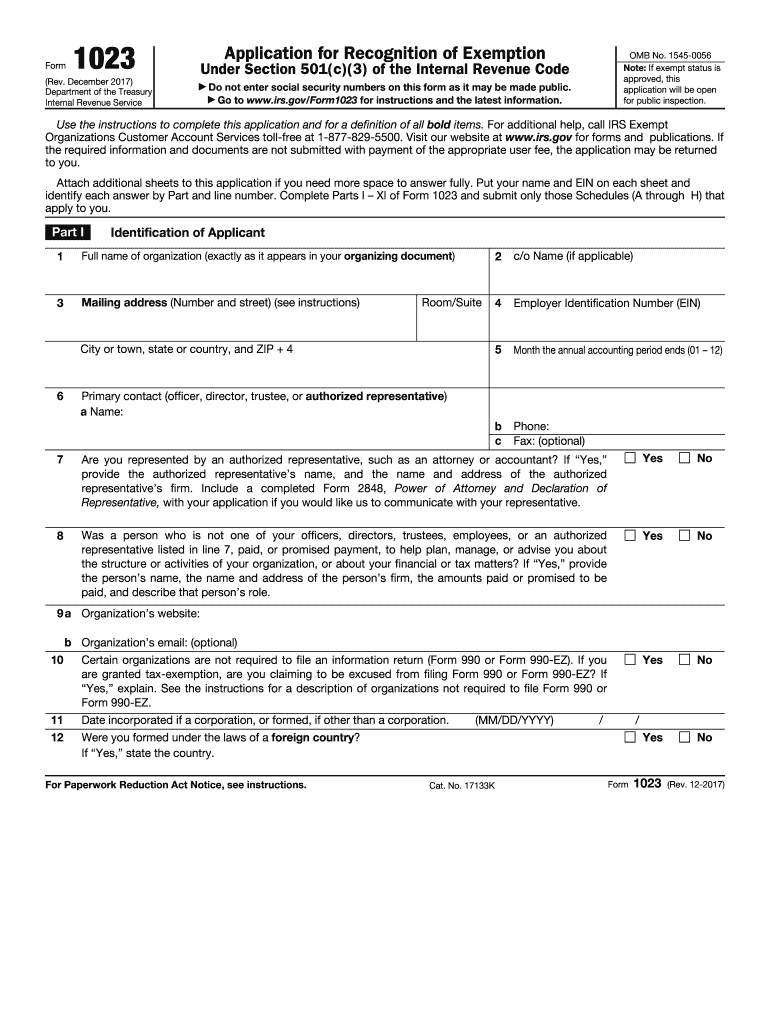

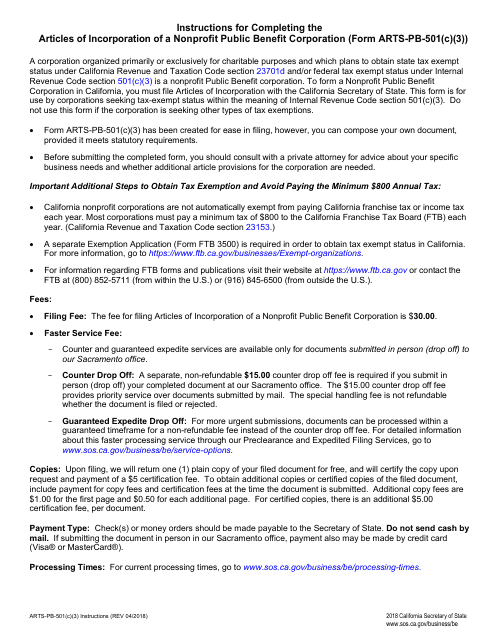

If the irs has questions or inquiries on your form 1023 or 1023 ez we handle those irs inquiries. The foundation group provides services for irs 501c3 501c3 tax exemption applications starting a nonprofit form 990 and statefederal compliance. The form you are looking for begins on the next page of this file. We take care of all forms including the form 1023 or form 1023 ez.

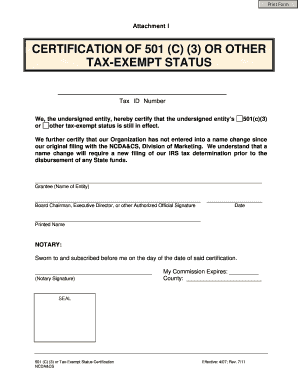

Information about form 1023 application for recognition of exemption under section 501c3 of the internal revenue code including recent updates related forms and instructions on how to file. Our 501c3 services are client friendly. If the irs approves the application it will issue a determination letter indicating the code section under which the organization is exempt from federal income tax. To apply for recognition by the irs of exempt status under section 501c3 of the code use a form 1023 series application.

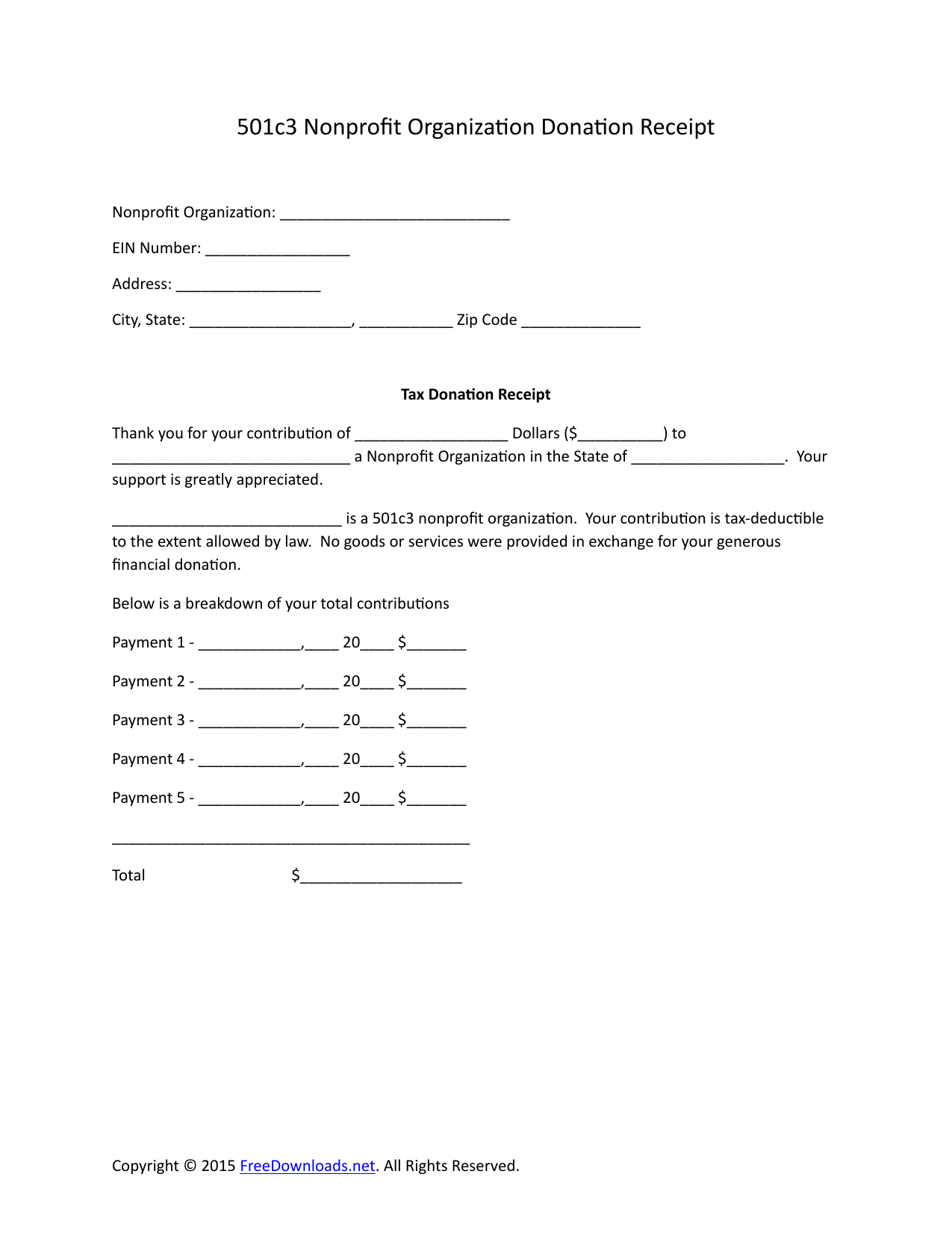

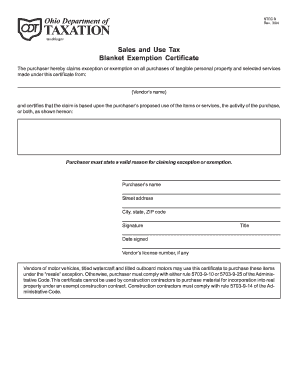

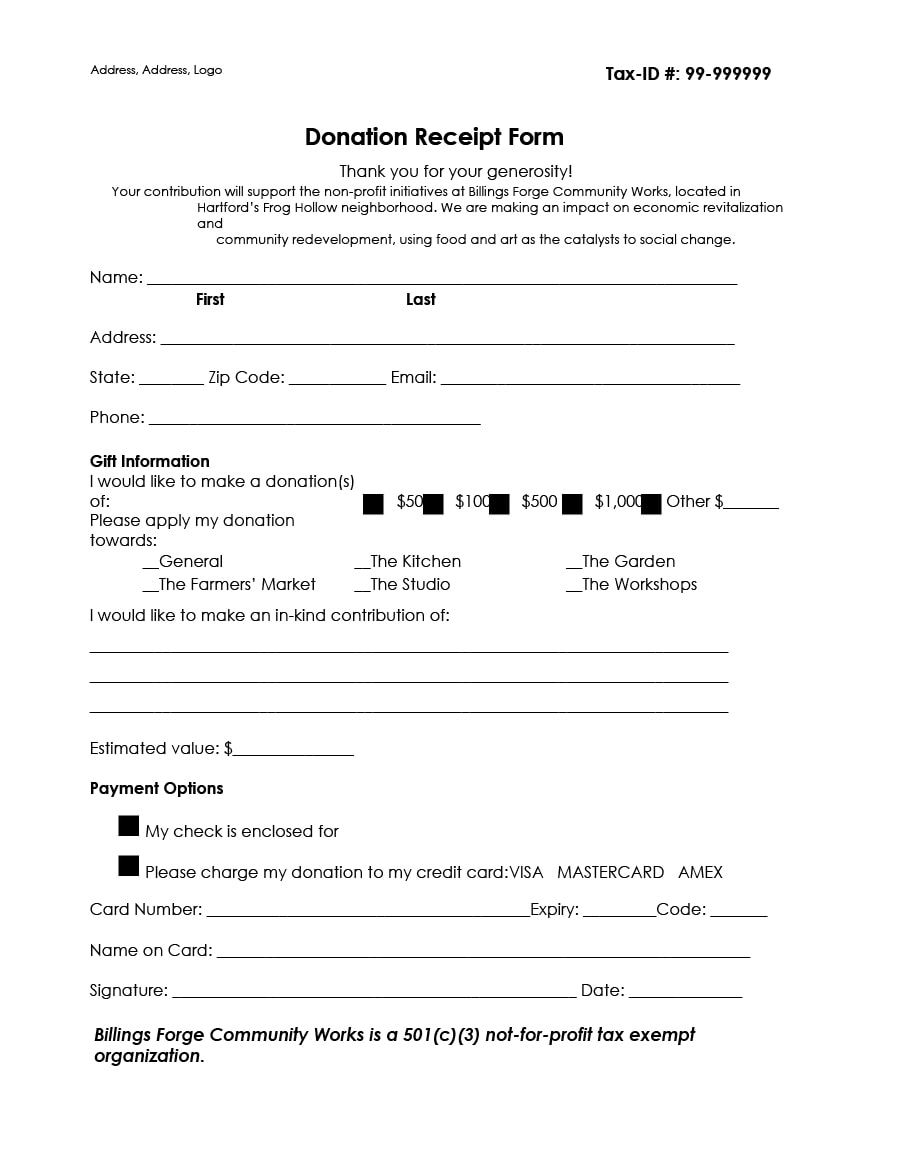

The application must be complete and accompanied by the appropriate user fee. This is not an official form to file with your annual taxes but may be needed in the event of a tax audit. The donation receipt letter for tax purposes also known as form 501c3 is a document to be given to a contributor of a non profit charity that is recognized by the internal revenue service. The mailing address for certain forms have change since the forms were last published.

The new mailing address are shown below.