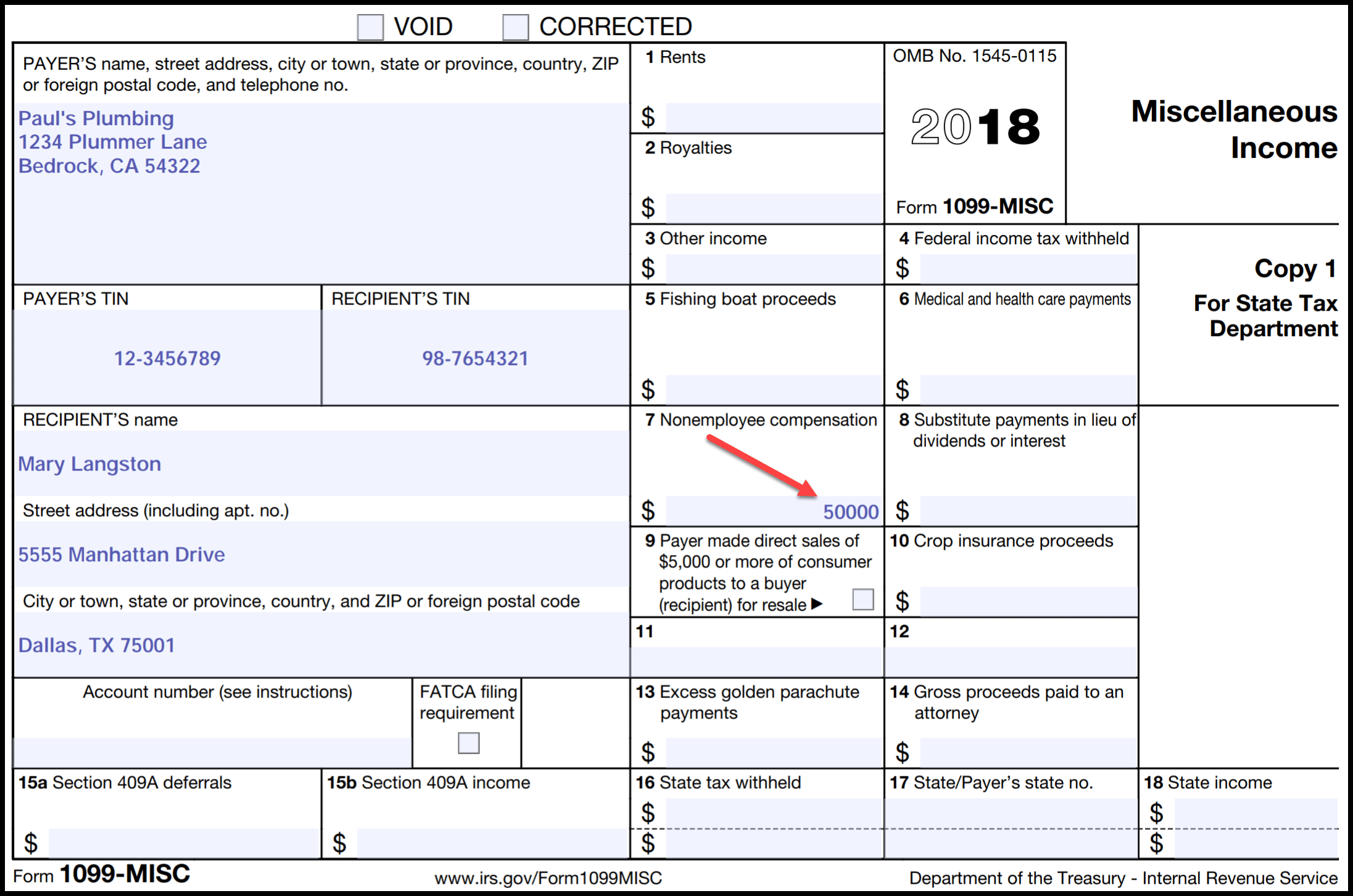

Printable 1099 Misc Form 2017

For all other reported payments file form 1099 misc by february 28 2018 if you file on paper or april 2 2018 if you file electronically.

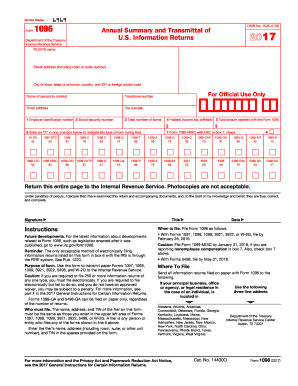

Printable 1099 misc form 2017. Use this step by step guide to fill out the 1099 misc 2017 form quickly and with excellent accuracy. Get the 1099 form 2017. That said you can obtain compliant form 1099 misc blank pages complete with the special red ink from most any local office supply store for very little money. Department of the treasury internal revenue service.

Purchase your 1099 kit by mid january so you can print. Print a test form before printing final forms. How to print your 10991096 forms in quickbooks desktop for mac. For internal revenue service center.

For example if you paid 650 to an independent contractor during the tax year of 2017 youd want to send one out to that particular contractor. Report payments made in the course of a trade or business to a person whos not an employee or to an unincorporated business. The way to complete the online 2017 1099 misc on the internet. File with form 1096.

File form 1099 misc for each person to whom you have paid during the year. Fillable form 1099 2017 misc. Form 1099 is one of several irs tax forms see the variants section used in the united states to prepare and file an information return to report various types of income other than wages salaries and tips. A penalty may be imposed for filing with the irs.

If you are a business owner you will need to fill it out and send it to anyone that you paid 60000 or more to during the previous tax year. Services performed by someone who is not your employee. To begin the form utilize the fill sign online button or tick the preview image of the form. The 1099 form 2017 reports income from self employment interests and dividends and government payments for 2017.

Payers use form 1099 misc miscellaneous income to. All of the national chains office depot staples etc also carry this standard product with a multi document packet typically costing between 5 and 10. At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest. At least 600 in.

Select print 1096s instead if printing form 1096. Report payments of 10 or more in gross royalties or 600 or more in rents or compensation. Select all vendors you wish to print 1099s for and choose the print 1099s button. Print and file copy a downloaded from this website.

Confirm your printer settings then select print.