How To Make A Receipt For Cash Payment

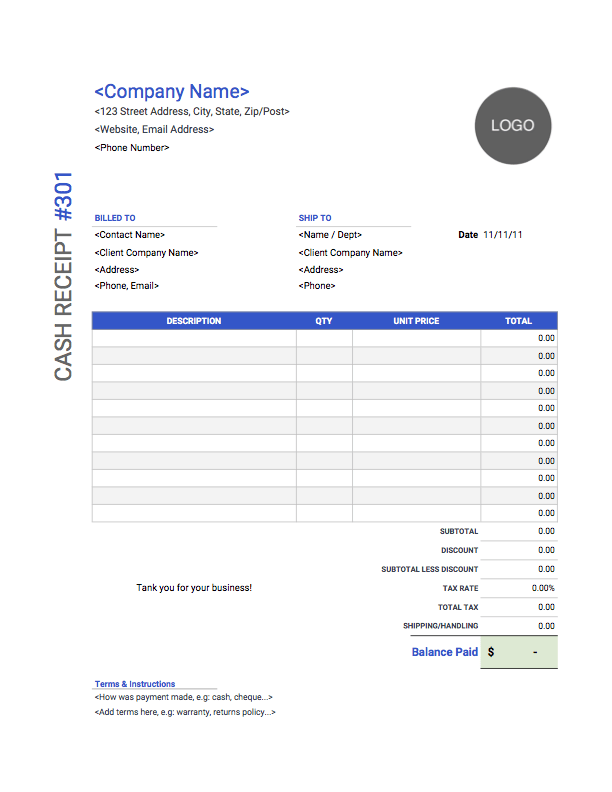

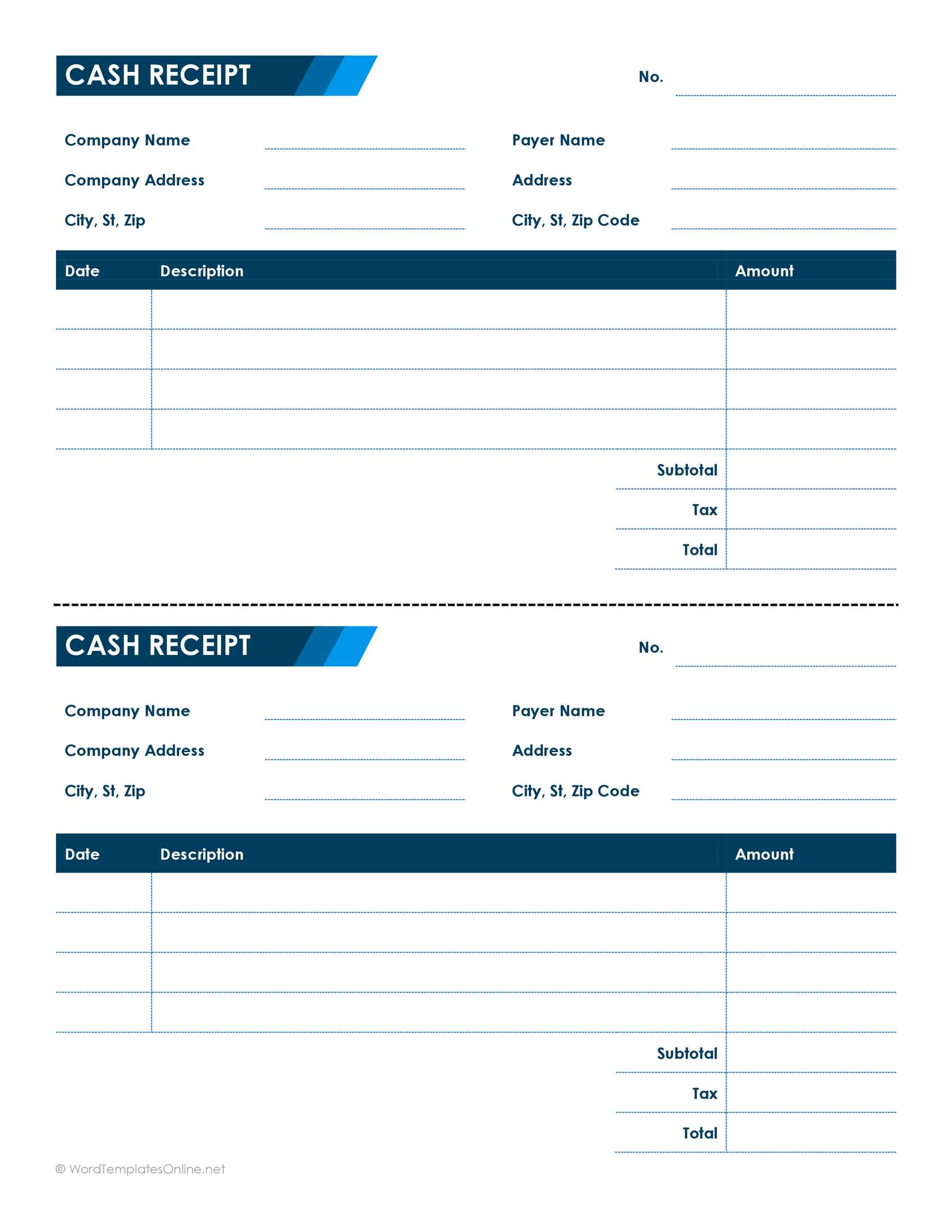

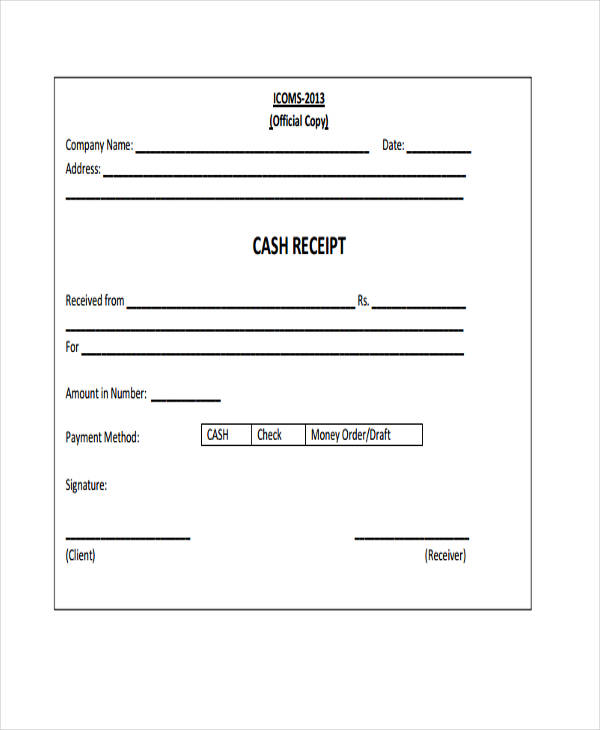

You can use a cash receipt template to easily create receipts for your customers who pay with cash for single or multiple items.

How to make a receipt for cash payment. Receipts serve as a document for customer payments and as a record of sale. Printable cash receipts in pdf and doc format. Cash receipts are accounted for by debiting cash bank ledger to recognize the increase in the asset. Subscribe to the free printable newsletter.

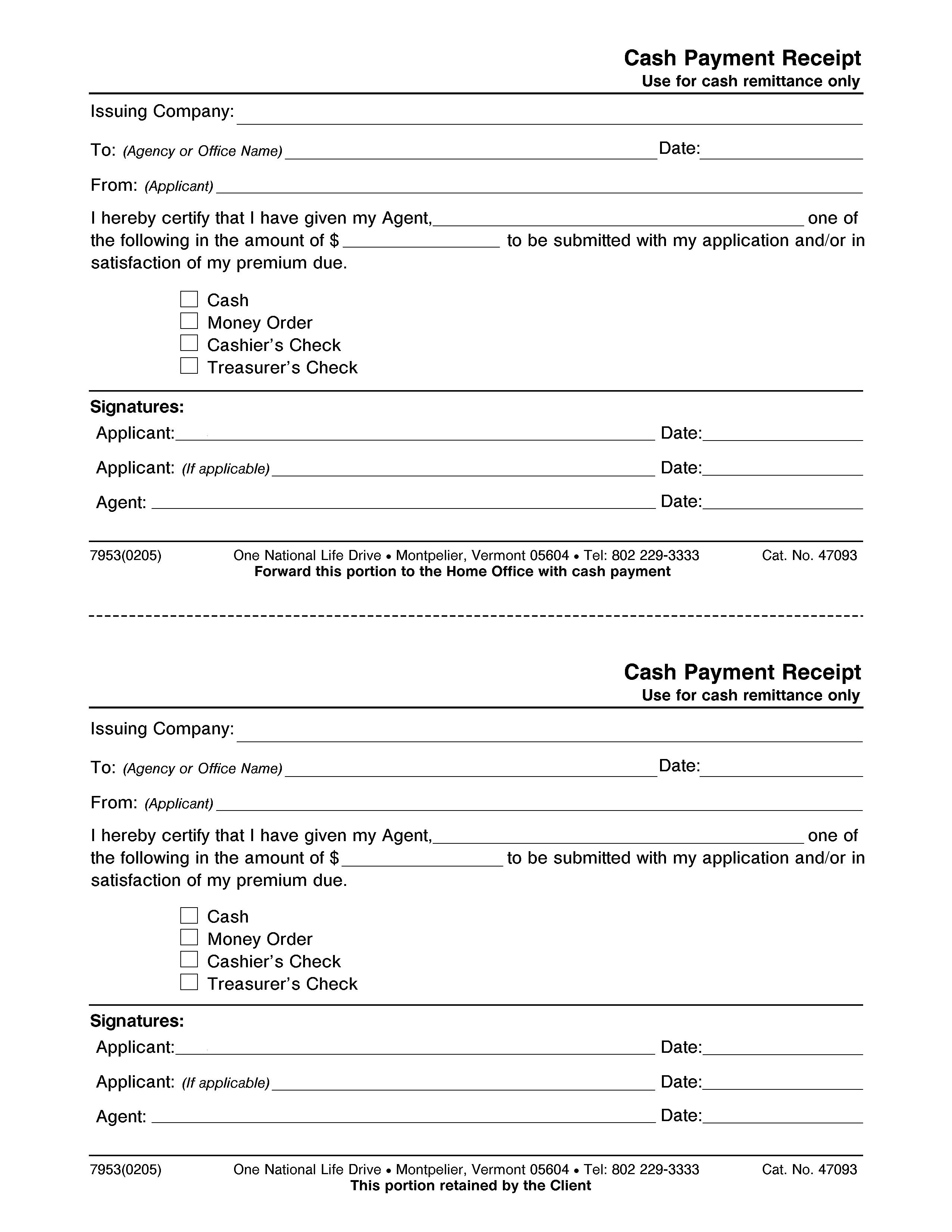

This cash receipt also comes in handy as additional proof of the sale. Cash transactions may be classified into cash receipts and cash payments. How to write a receipt. Check out our online receipt maker to create a receipt you can use for all of your cash paying customers.

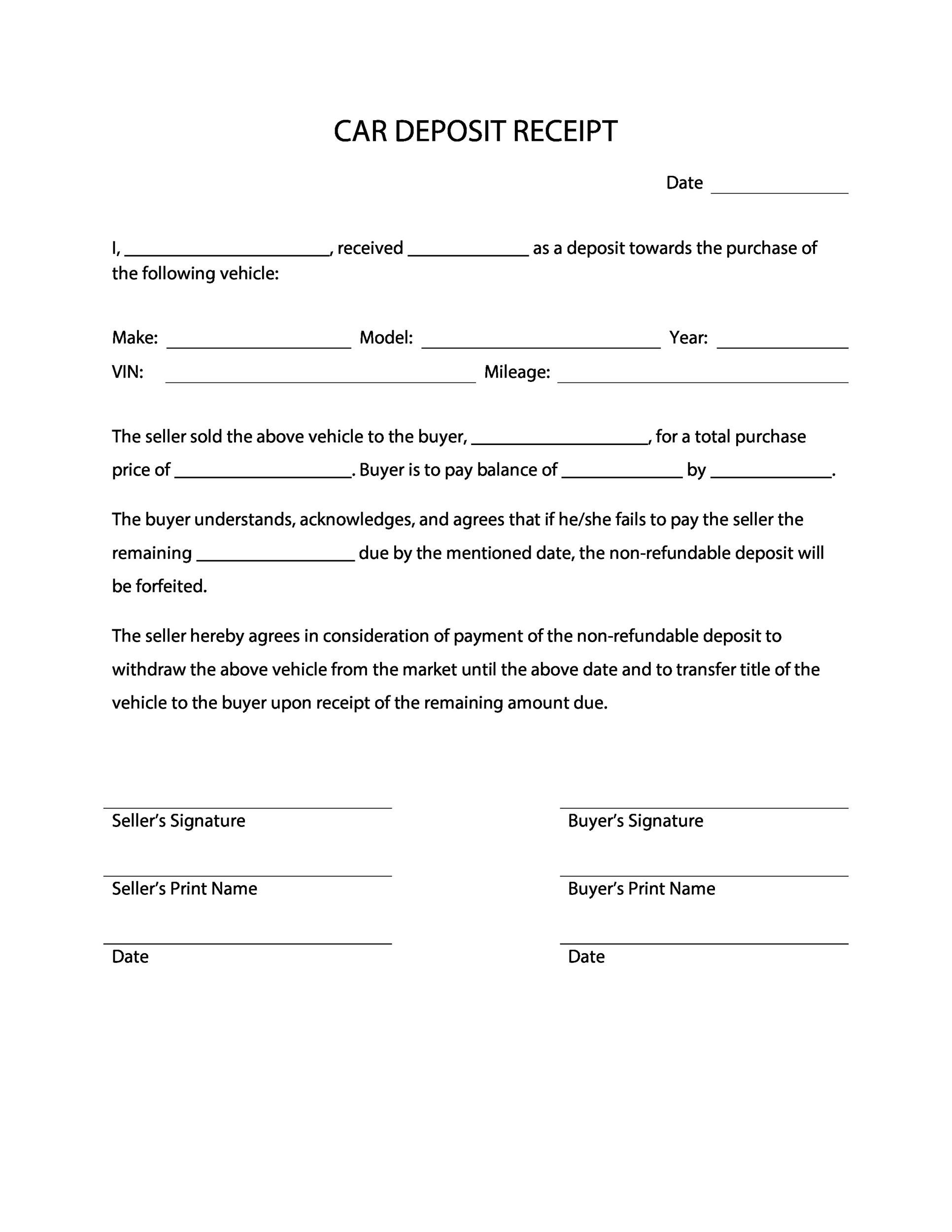

Whether you use cash or a check to buy a used car from a private seller its wise to document the transaction with a receipt. This paperwork is especially important for a cash payment which unlike a check cannot be easily verified or traced. When youre ready to make a new receipt whether its a receipt template for selling clothing a rent receipt template as a landlord or even a cash receipt template for a big sale simply open a new receipt and voila. Cash transactions also include transactions made through cheques.

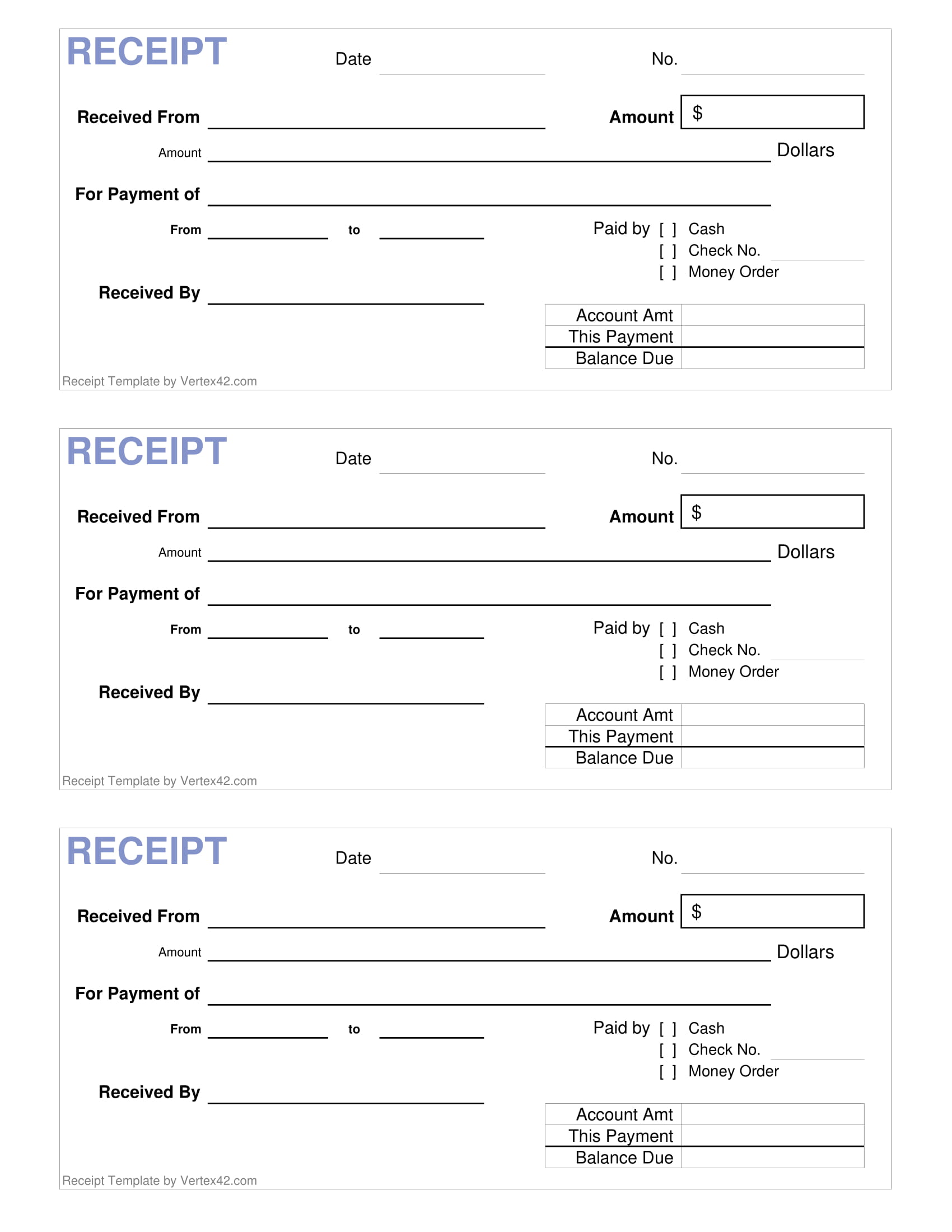

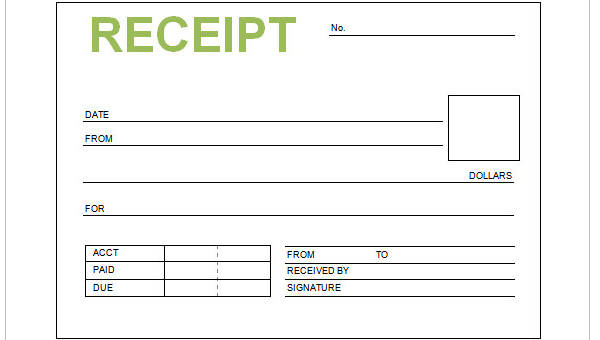

Following are common types of cash receipt transactions along with relevant accounting. A receipt template is an easy to use form that enables businesses including landlords to quickly create receipts. If you want to provide a customer with a receipt you can handwrite one on a piece of paper or create one digitally using a template or. A receipt template documents the date the amount paid the reason for the payment and who made the payment.

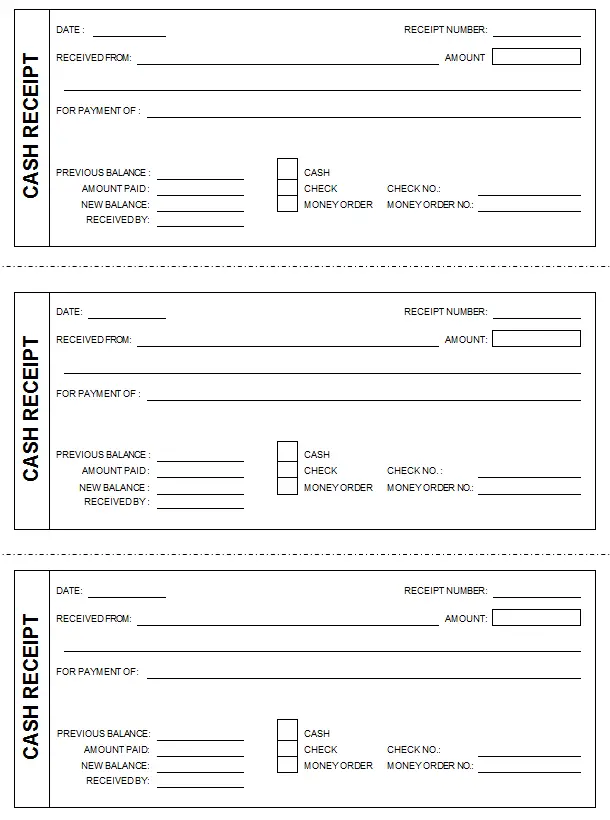

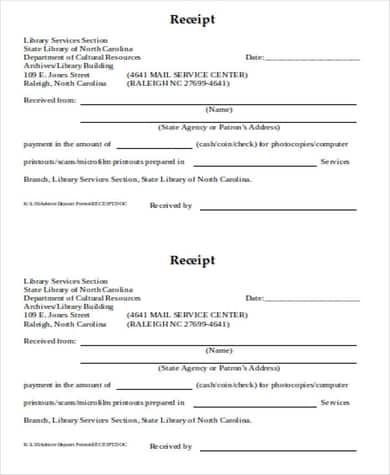

No spam ever subscribe free these receipt templates are easy to download and print. You need a receipt to track your sales and products sold. A cash payment receipt is an instrument which shows when where why and by whom the payment was made and received. The cash receipt template lets you create 3 receipts per page for cash check or money order payments.

How to write a payment receipt for irs purposes every business expense payment receipt must include the day month and year that the transaction took place a list of all items bought or services provided and the total amount paid. Your saved information is automatically imported from our system.