Employment 2019 W 4 Form Printable

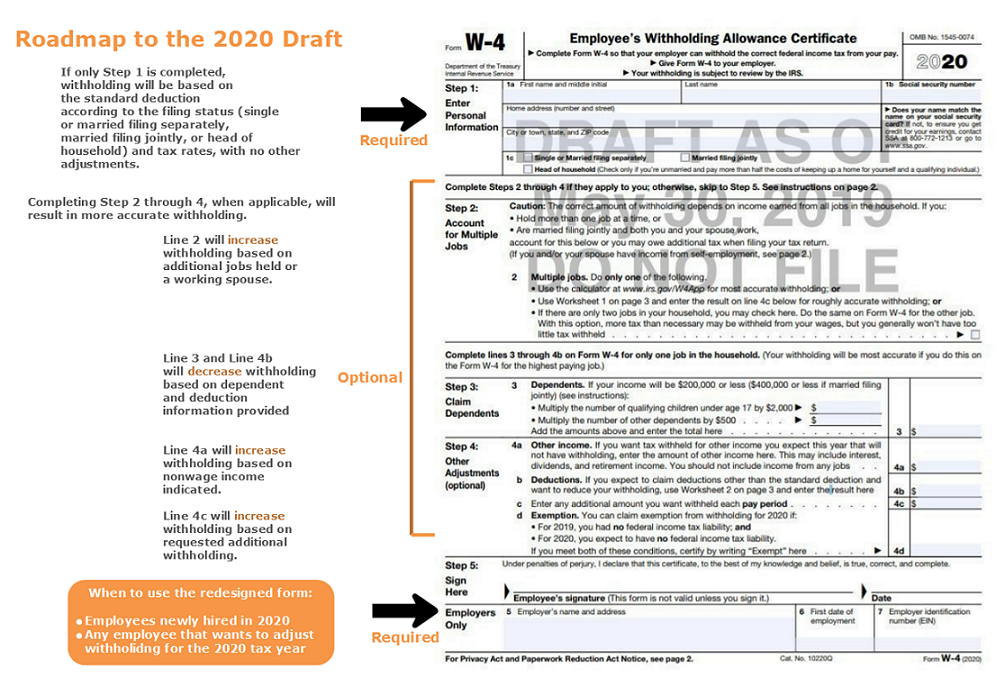

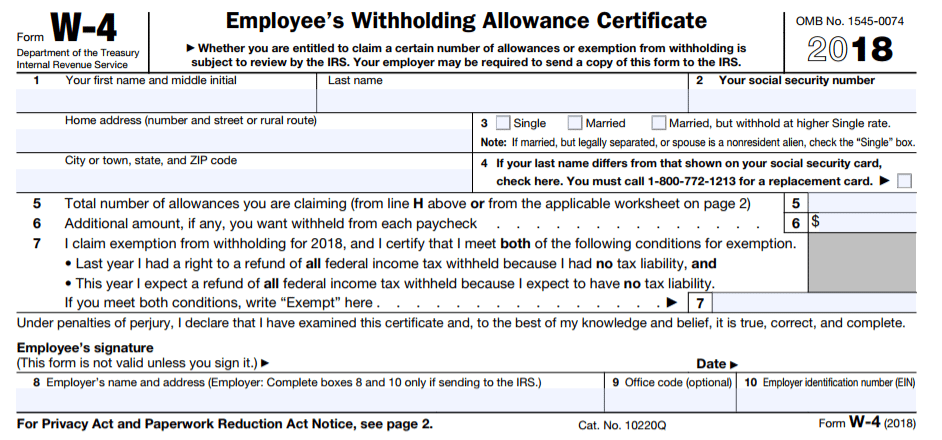

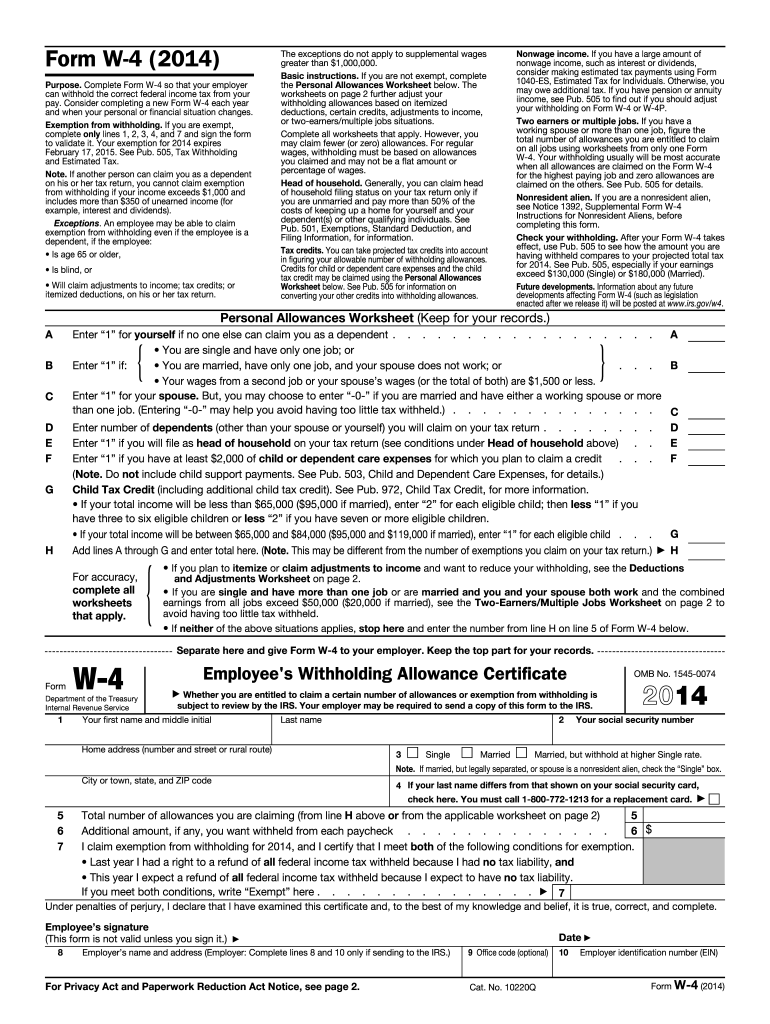

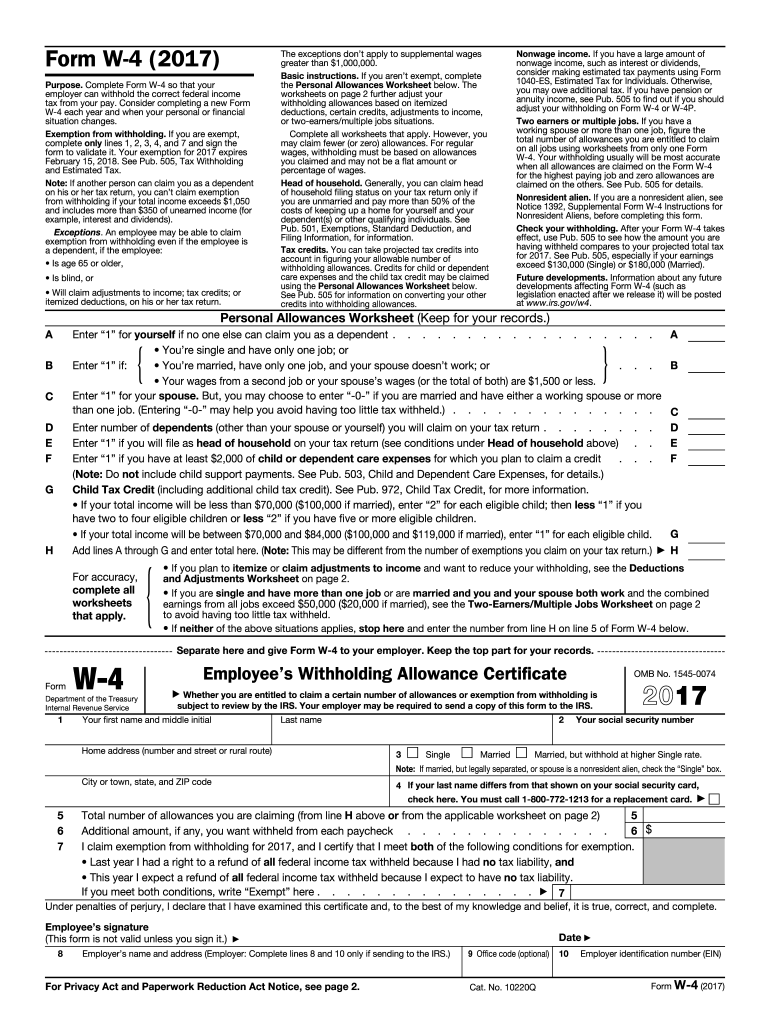

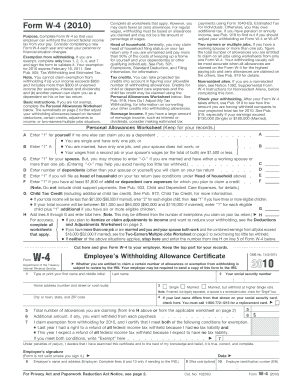

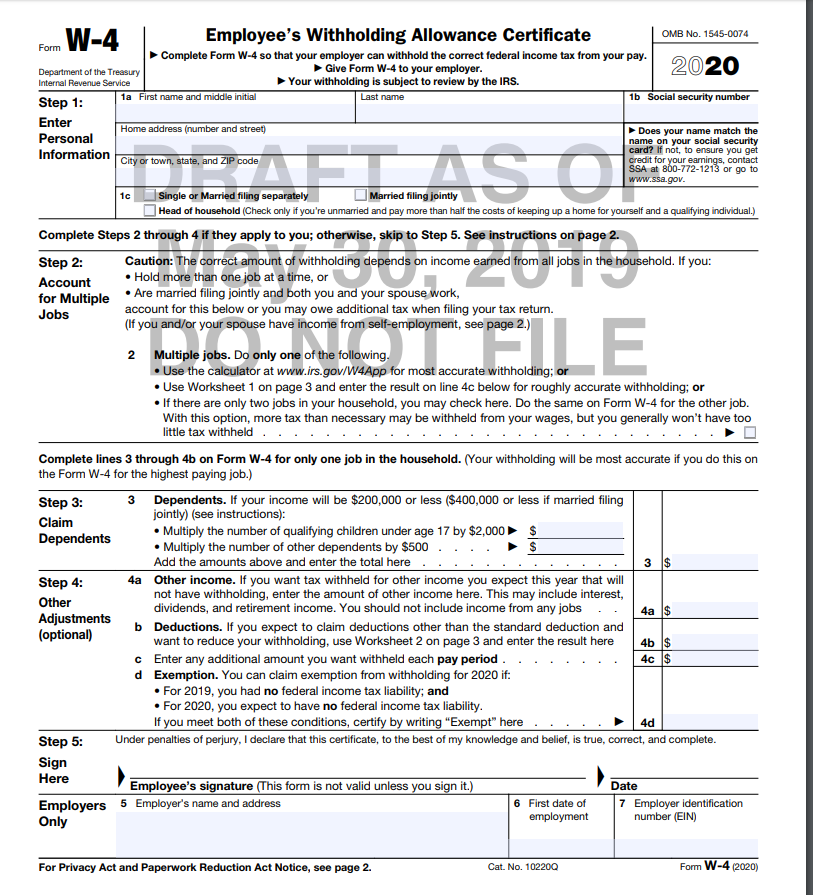

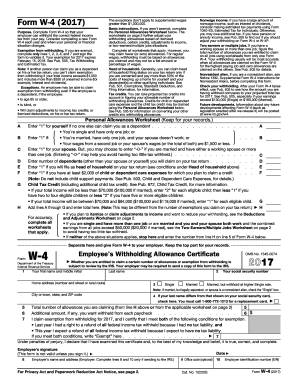

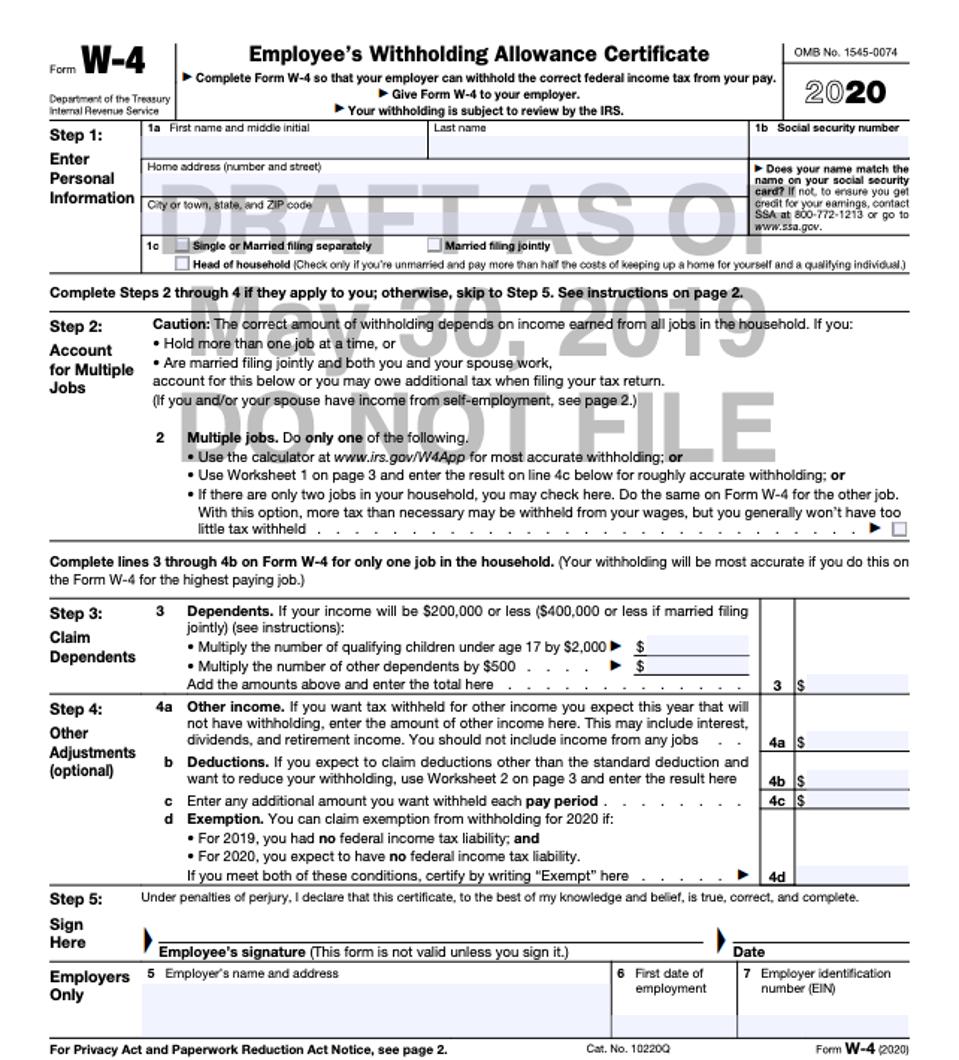

Complete form w 4 so that your employer can withhold the correct federal income tax from your pay.

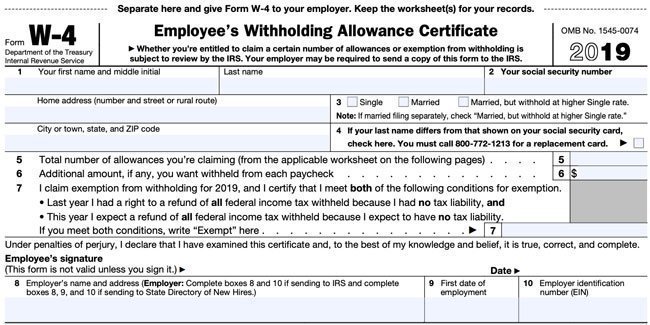

Employment 2019 w 4 form printable. Enter the employers name and. Withholding certificate for pension or annuity payments 2020. Withholding certificate for pension or annuity payments 2019 02032020 form w 4p. For information and.

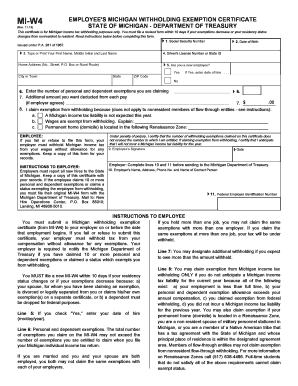

Employment for at least 60 consecutive days. Employment eligibility verification department of homeland security us. Find employment tax forms a small business or self employed person needs to file their taxes. Line 16 on your 2019 form 1040 or 1040 sr is zero or less than the sum of lines 18a 18b and 18c or 2 you were not.

2019 12132019 form w 4 sp employees withholding certificate spanish version 2020 01022020 form w 4p. Information about form w 4 employees withholding certificate including recent updates related forms and instructions on how to file. Form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Employment for at least 60 consecutive days.

You may claim exemption from withholding for 2019 if both of the following apply. Internal revenue service form w 4. Self employment taxes on any self employment income you receive separate from the wages you receive as an. Employers should contact the appropriate state directory of new hires to.

Only employers and employees in puerto rico can complete the spanish version of form i 9. Instructions are included with the form unless otherwise noted. Citizenship and immigration services form i 9 10212019 page 1 of 3 start here. The instructions must be available either in paper or electronically during completion of this form.

Employment tax forms internal revenue service. New employees complete this form within the first five days of your employment to select an arizona withholding percentage. Read instructions carefully before completing this form. Territories may print this for their reference but must complete the form in english to meet employment eligibility verification requirements.

Wages that will generally be in box 1 of your federal form w 2. Consider completing a new form w 4 each year and when your personal or financial situation changes. It is your gross wages less any pretax deductions such as your share of health insurance premiums. Form w 4 2019 future developments.

Employers should contact the appropriate state directory of new hires to find out how to submit a copy of the completed form w 4. Spanish speaking employers and employees in the 50 states and other us.

/Form-w4-a3514b86fc7147d2abaec5bd575f11b4.jpg)