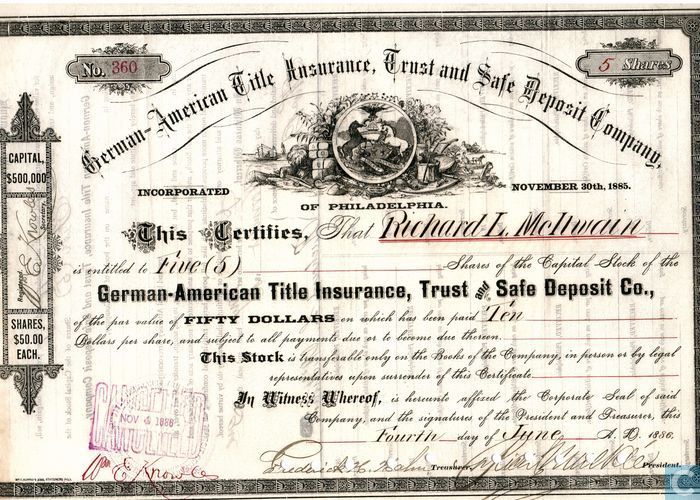

Title Insurance Certificate

Both provide proof of ownership of property.

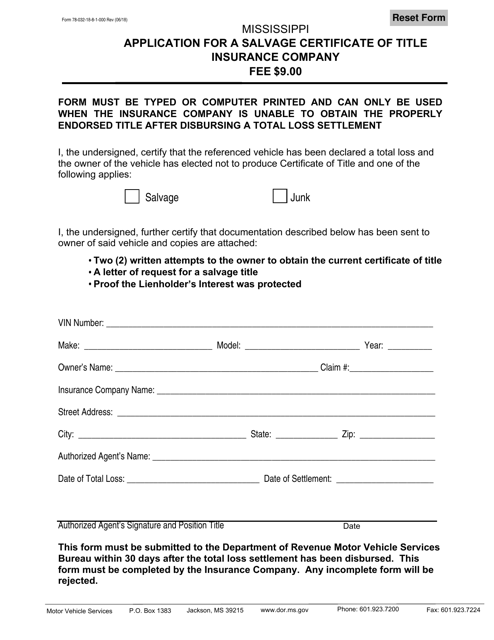

Title insurance certificate. Title insurance like a certificate of title is issued based on a full abstract of title of at least 50 years prepared following a title examination. Apply for both a vehicle registration and a title certificate at the same time. Certificate of title vs. The rate calculator reflects the rate deviation filed by stewart title insurance company.

Replace a lost title certificate deceased owner. The similarity between the two documents ends there. Title insurance is often cheaper than obtaining a survey on a single family residence but it generally only applies to the mortgage being insured. The office of general counsel issued the following opinion on april 11 2007 representing the position of the new york state insurance department.

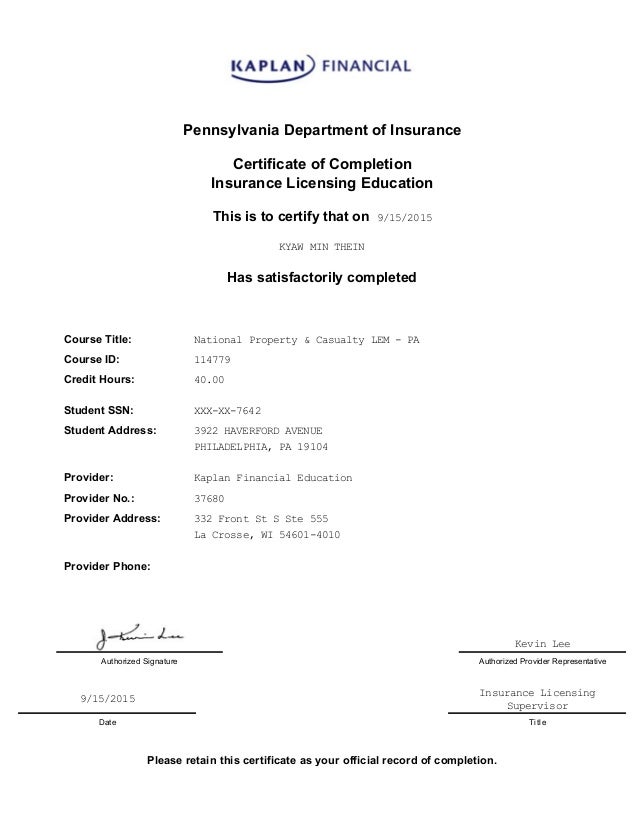

The certificate of title therefore is a statement of opinion that a title company or attorney believes the property is owned free and clearbased on researching available public records. Licensing and education requirements for title insurance agents question presented. Your duplicate title certificate will be sent to the address on file at the dmv. The title insurance rates charged by title companies are regulated by the state of new york.

Title insurance works like a standard insurance policy. If you moved learn how to change your address. It protects against future discoveries about a property some title related and some non title related. Title companies are permitted to charge extra for the service of retrieving certificates of occupancy.

Read information about transferring ownership when the previous owner is deceased. Deeds and certificates of title have one function in common. Is any change to the insurance law or its regulations currently being contemplated that would require real estate title insurance agents to be licensed or take classes. There is no financial benefit to valley mortgage company inc.

The certificate of title will contain enough information to. It is a form of indemnity insurance for a mortgaged property that covers the loss of an interest in a property due to discovered legal defects.