St Louis County Real Estate Tax Receipt

Obtaining a property tax receipt.

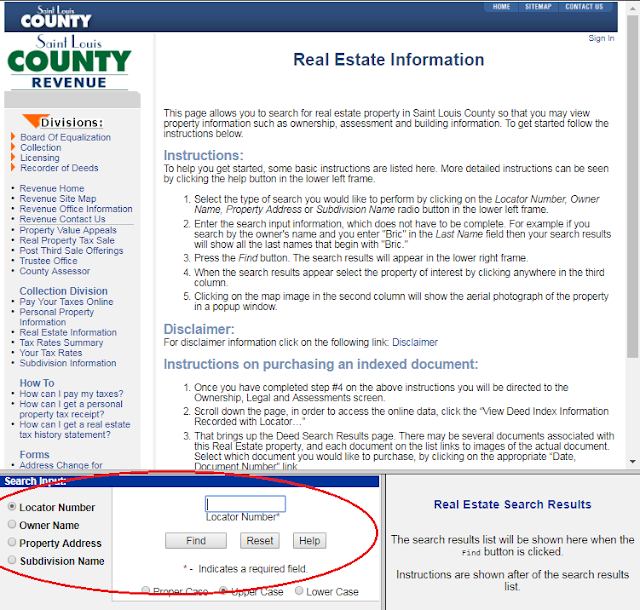

St louis county real estate tax receipt. If you did not file a personal property declaration with your local assessor and did not receive a personal property bill you will need to file with your assessors office first. Property tax receipts are obtained from the county collector or city collector if you live in st. For up to date andor certified information the user should contact the st. Louis county resident use the st.

You may click on this collectors link to access their contact information. The collector of revenue serves as the billing collecting and disbursing agent for more than 200 different taxing districts in st. This data is intended to be used for informal purposes only. The saint louis county collector of revenues office conducts its annual real property tax sale on the fourth monday in august.

After the payment has posted which can take up to five business days for online and telephone payments personal property tax receipts are available either by mail online or at our offices. Tax start page visit both your personal property and real estate tax pages enter your address and check your amounts. Sale instructions and listings of available properties are published online approximately one month before the sale. Louis city in which the property is located and taxes paid.

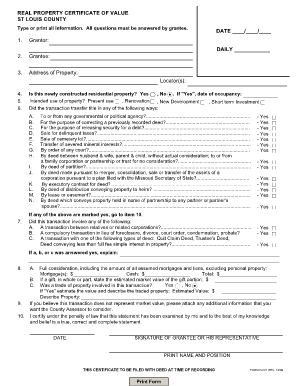

It is not intended for use in abstract work land surveys title opinions appraisals or other legal documents or purposes. When you pay your taxes the collectors office will send you a tax receipt by mail after your payment has posted to your account. Louis county department of revenue. Bills collects and distributes personal and real estate taxes.

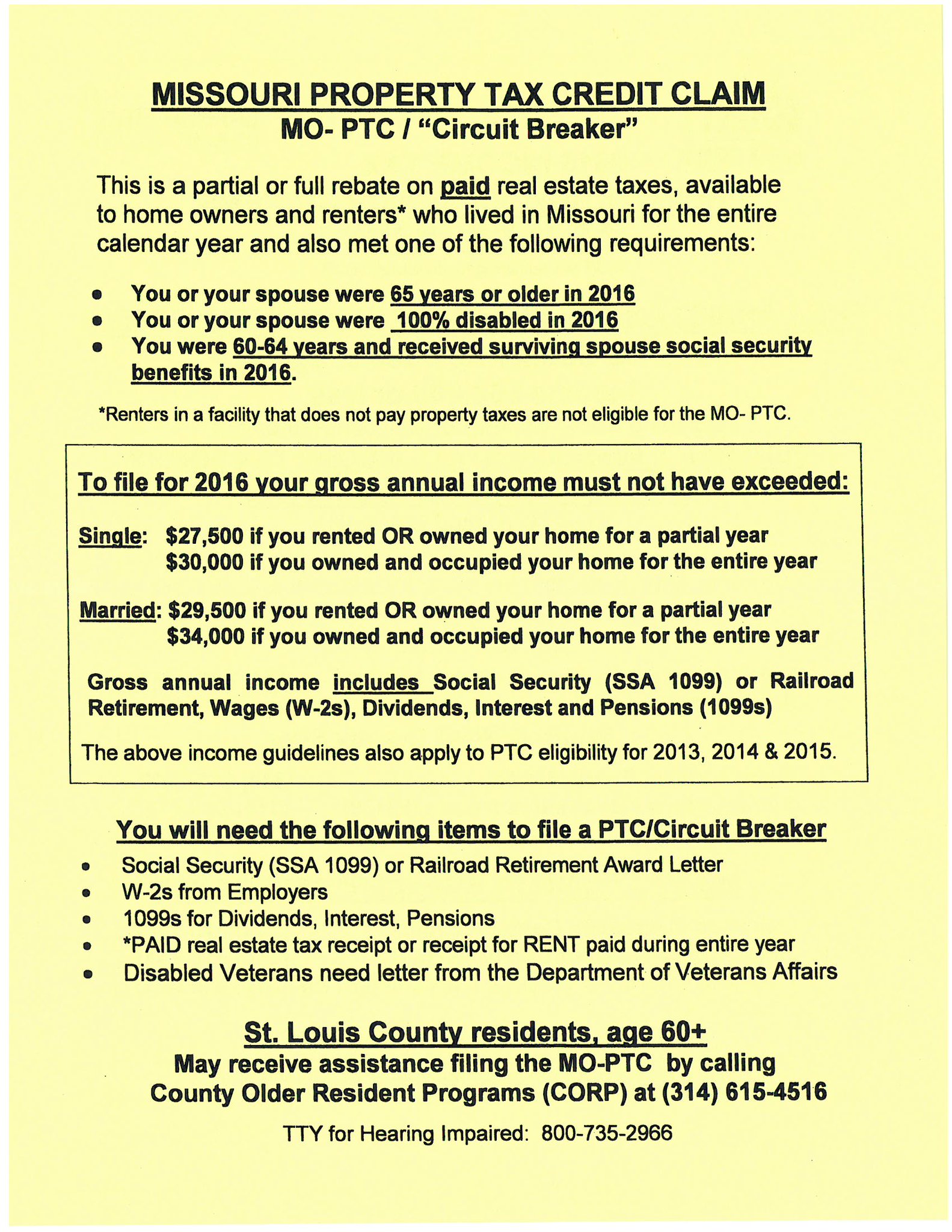

Property taxes and tax receipts tweet property values are assessed and paid locally. All online payments pay a traffic ticket shelterpavilion reservation acquire a divorce record purchase a copy of a birth or death certificate and more. 2019 data is available. Louis county personal property tax lookup.

The collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 18 billion annually for. The department of revenue consists of three main divisions. Issues liquor amusement tow truck solicitor and other miscellaneous licenses. Charles county collectors office is committed to providing efficient tax payment collection and disbursement operations and to providing exceptional customer service to the taxpayers by promptly and professionally waiting on them at the windows pleasantly and patiently answering telephone inquiries and courteously and creatively handling problems.

2019 data is available.