Resale Certificate Ny

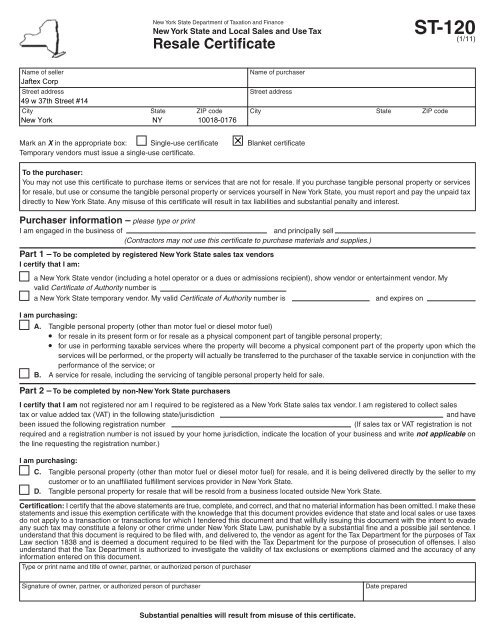

D h tangible personal property for resale that will be resold from a business located outside new york state.

Resale certificate ny. Sellers are not required to accept resale certificates however most do. New york resale certificates that select blanket certificate do not expire. Any other use of the resale certificate is usually considered unlawful. Accepting this certificate this certificate cannot be used to purchase motor fuel or diesel motor fuel.

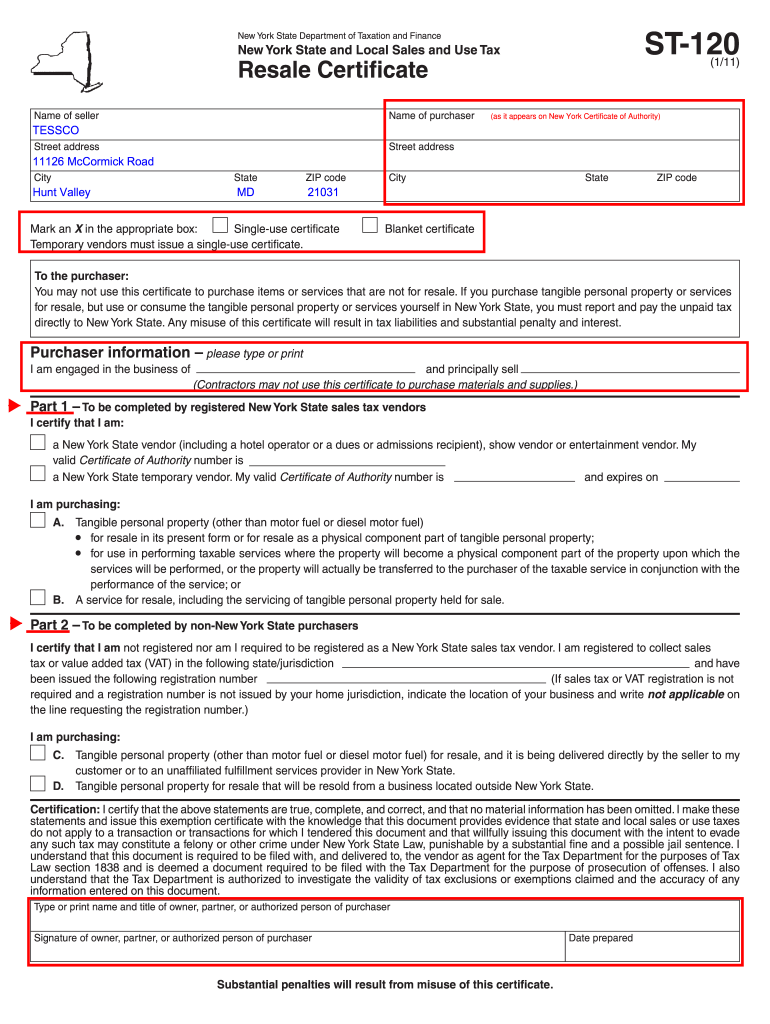

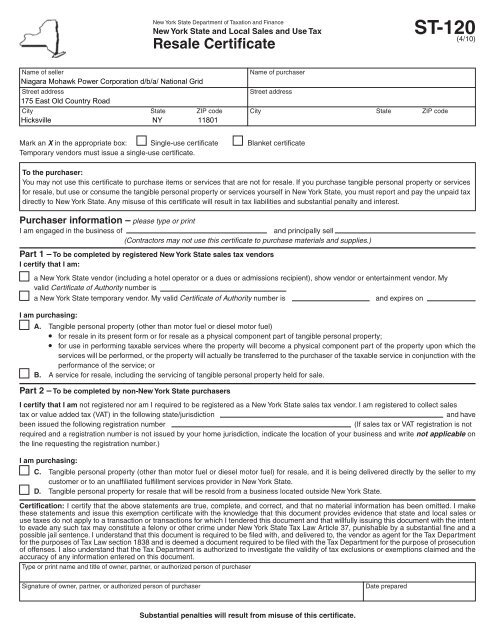

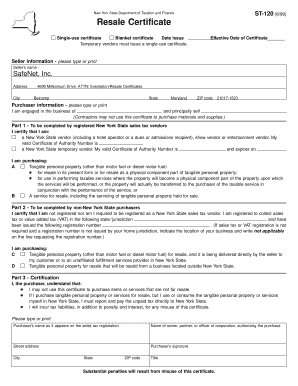

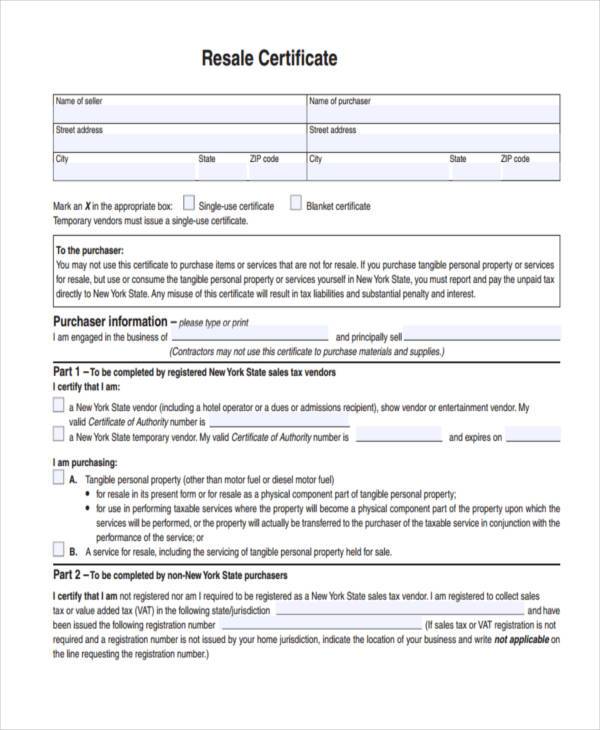

New york state and local sales and use tax to purchasers and sellers. Resale certificate read instructions on back carefully before issuing or this certificate cannot be used by contractors to purchase materials and supplies. September 2 2011 introduction. This registration also allows you to buy items from retailers tax.

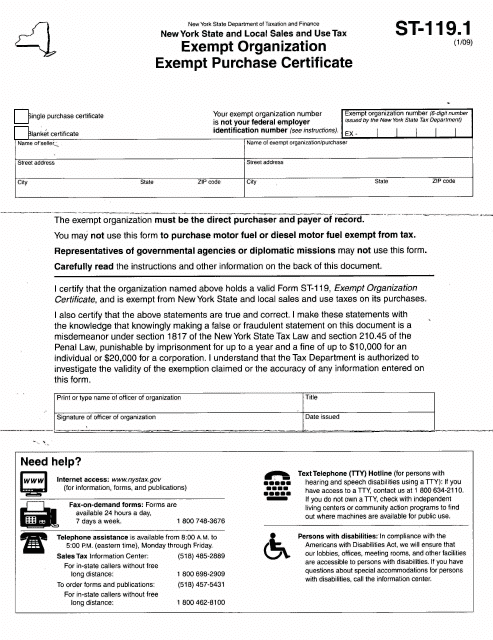

If the vendor doesnt accept the certificate the buyer will have to pay sales tax on the merchandise being purchased. Exemption certificate for purchases relating to guide hearing and service dogs. If you give a properly completed exemption certificate to the distributor in this case form st 120 resale certificate. St 860 fill in instructions on form.

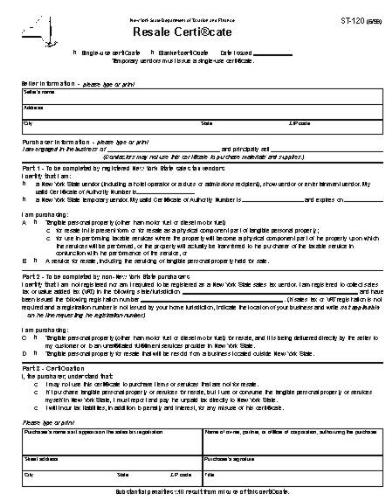

Exemption certificate for the purchase of a racehorse. Are sellers required to accept resale certificates. If you will be making sales in new york state that are subject to sales tax you must register with the tax department and obtain a certificate of authority. Single use certificate blanket certificate temporary vendors must issue a single use certificate.

Form st 120 is a new york state department of taxation and finance form also known as the resale certificatethe latest edition of the form was released in june 1 2018 and is available for digital filing. Department of taxation and finance new york state and local sales and use tax resale certificate mark an x in the appropriate box. No but must be a new york state government employee or employee of a political subdivision. Nys sales tax certificate of authority dtf 17.

C h tangible personal property other than motor fuel or diesel motor fuel for resale and it is being delivered directly by the seller to my customer or to an unafliated fulllment services provider in new york state. New york state and local sales and use tax exemption certificate tax on occupancy of hotel or motel rooms. Download an up to date form st 120 in pdf format down below or look it up on the new york state department of taxation and finance forms website. How to register for new york state sales tax tax bulletin st 360 tb st 360 printer friendly version pdf issue date.

If you will be making sales in new york state that are subject to sales tax you must register with the tax department and obtain a certificate of authority online at new york business express. St 129 fill in instructions on form.