Nebraska Inheritance Tax Worksheet 2019

The tax is a state of nebraska inheritance tax but the county receives the money.

Nebraska inheritance tax worksheet 2019. The form must be filed and inheritance taxes must be paid within twelve months after the decedents date of the death. The tax is paid to the county of the deceased persons residence or in the case of real estate to the county in which the real estate is located. In order to become a legal heir to a decedents estate in nebraska you must live for more than 120 hours or five days after the individuals death according to nebraska inheritance laws. These forms are from supreme court rules the administrative office of the courts the nebraska supreme court committee on pro se litigation and other organizations.

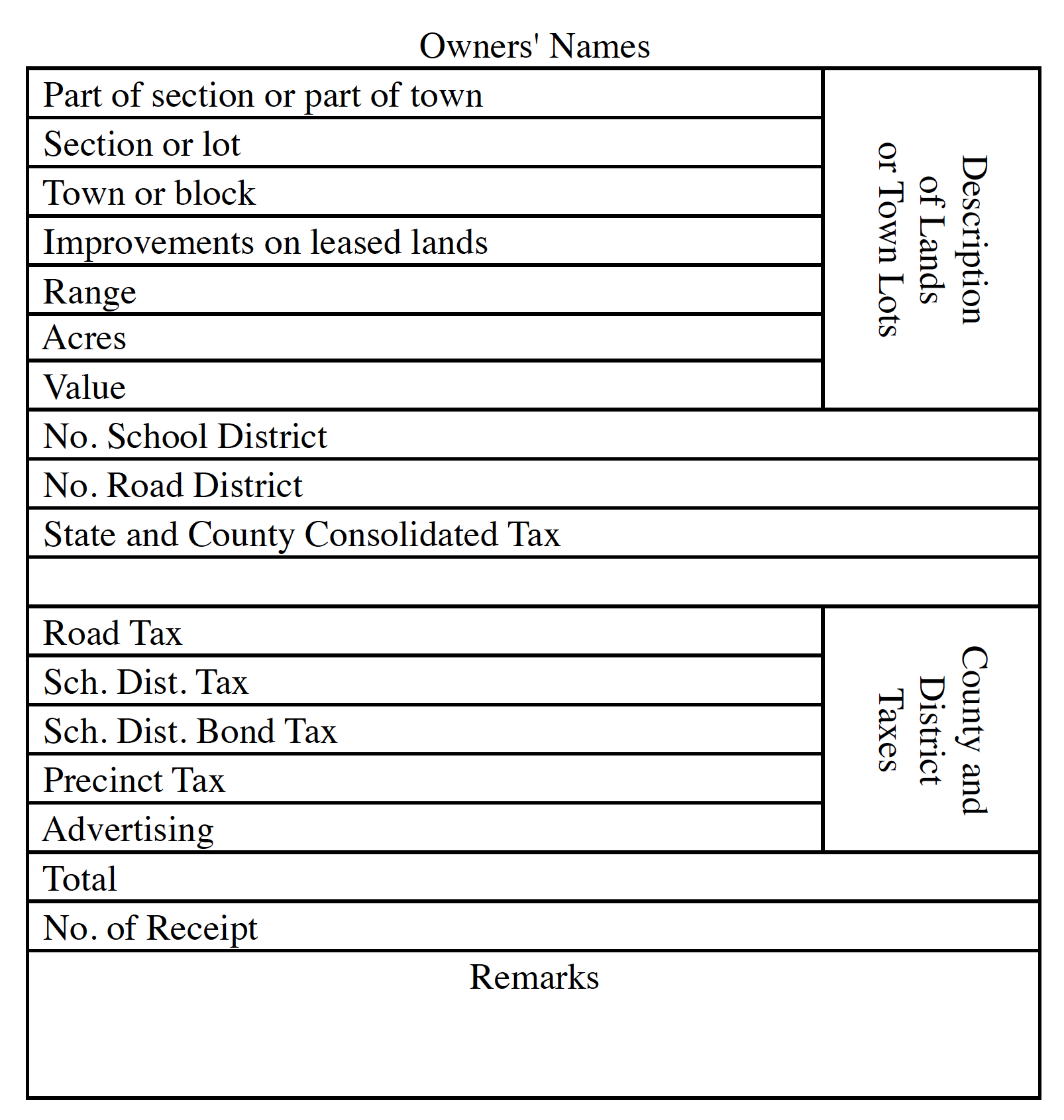

Home worksheet nebraska probate form 500 inheritance tax worksheet nebraska probate form 500 inheritance tax worksheet february 15 2019 by role. Estate executor spreadsheet for nebraska inheritance tax worksheet 311106 estate and gift tareturns. Unlike a typical estate tax nebraska inheritance tax is measured by the value of the portion of a decedents estate that will be received by a beneficiary. An inheritance tax worksheet called probate form 500 must be filed with the county court of the county in which the decedent resided or in which the decedents real or personal property is located.

The inheritance tax rate depends on how closely the person who inherits the property was related to the deceased person. Furthermore the extent to which such portion is subject to tax depends on the decedents relation to the beneficiary. Should a possible intestate or testate heir murder a decedent he or she will lose all inheritance rights to the estate. Nebraska taxes property that is left by deceased nebraska residents or by nonresidents who owned real estate or other tangible property in the state.

:max_bytes(150000):strip_icc()/GettyImages-697982628-5bad233946e0fb002644b7e0.jpg)