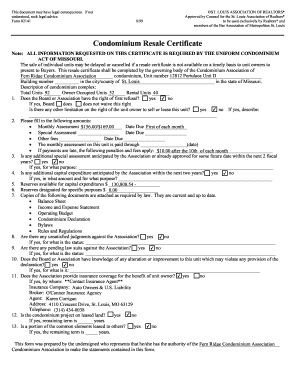

Missouri Resale Certificate

However there are a number of exemptions and exclusions from missouris sales and use tax laws.

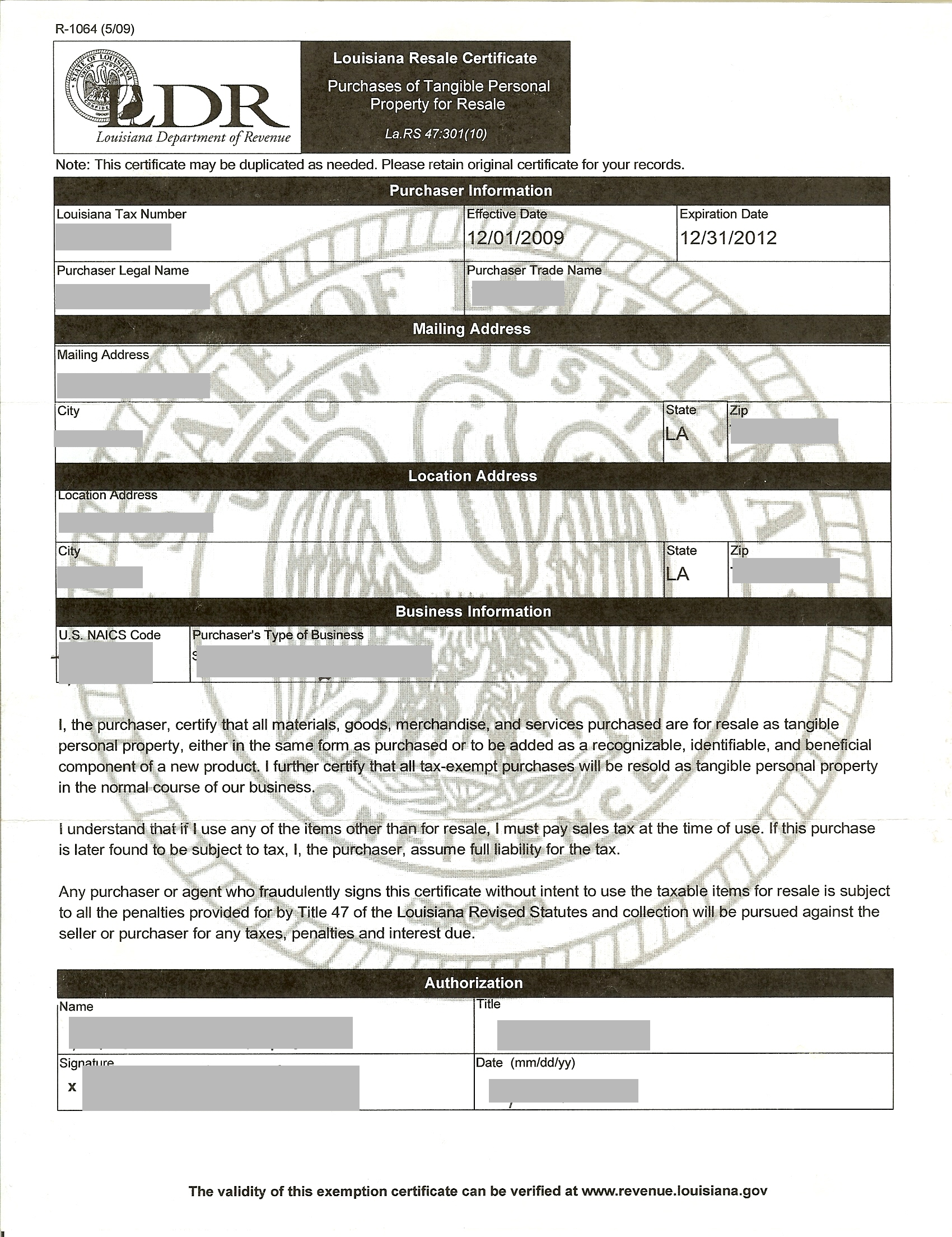

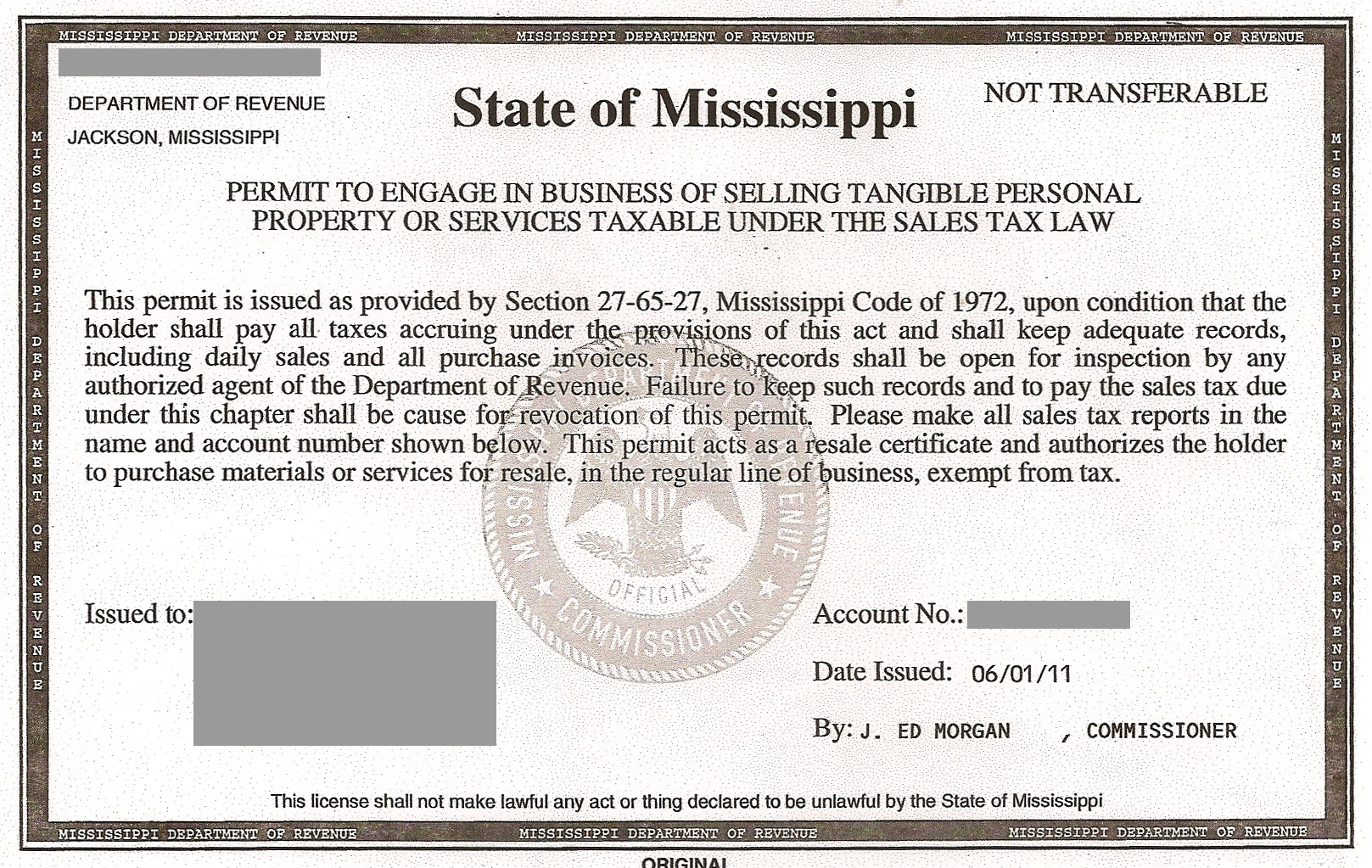

Missouri resale certificate. A missouri state resale certificate can be used to purchase items at wholesale costs and will allow you to resell those items. Acceptance of uniform sales tax certificates in missouri. Purchasers for resale must have a missouri retail license in order to claim resale of taxable services n missouri. A taxable service includes sales of restaurants hotels motels places of amusement recreation entertainment games and athletici.

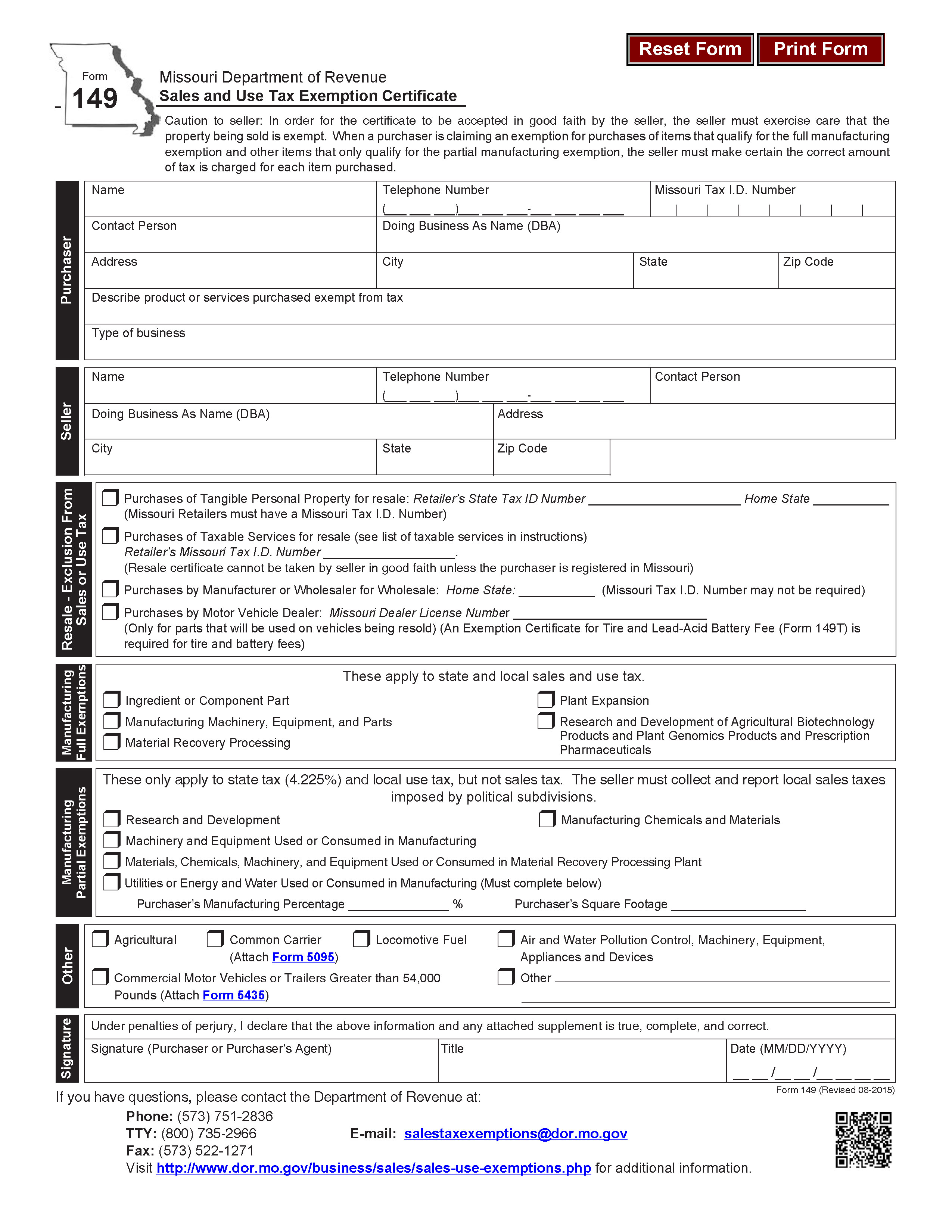

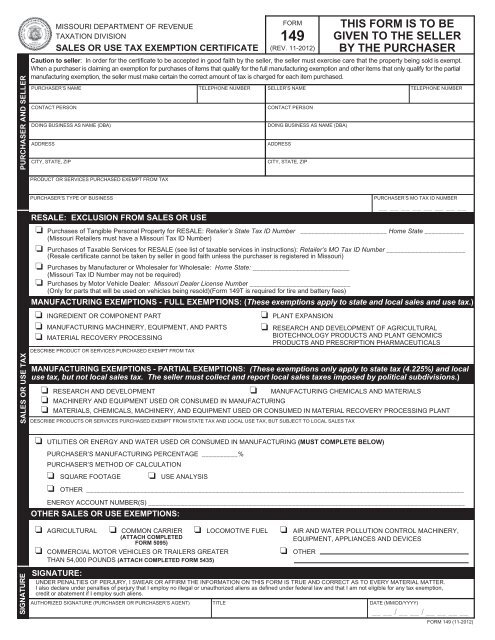

Missouri tax exemption missouri resale certificate missouri sale and use tax missouri wholesale certificate etc. Also known as. Sales and use tax exemption certificate document title. The missouri department of revenue administers missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax.

Missouri does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re used for all exempt purchases made from that vendor. Missouri sales tax resale certificate number. Here are the rules and regulations for using and accepting a resale certificate in missouri. How to use a missouri resale certificate.

Most businesses operating in or selling in the state of missouri are required to purchase a resale certificate annually. Any other use of the resale certificate such as buying office supplies or personal items is usually considered unlawful. In missouri you are allowed to buy items tax free as long as you intend to resale them. A new certificate does not need to be made for each transaction.

If you do not sell taxable tangible personal property at retail or provide taxable services in missouri the department will provide a vendor no tax due certificate that you can present to missouri purchasing authorities. Sales and use tax exemption certificate form 149 missouri department of revenue sales and use tax exemption certificate form 149 caution to seller. Missouri sales and use tax exemptions and exclusions from tax generally missouri taxes all retail sales of tangible personal property and certain taxable services. Obtain a vendor no tax due certificate from the missouri department of revenue by following the procedures outlined below.

Even online based businesses shipping products to missouri residents must collect sales tax.