General Liability Certificate

You apply for professional licenses.

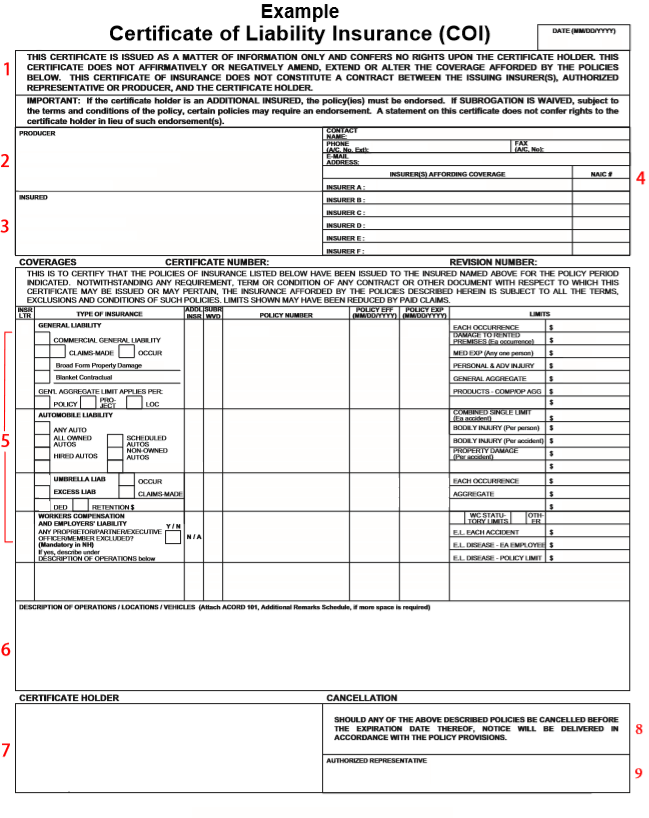

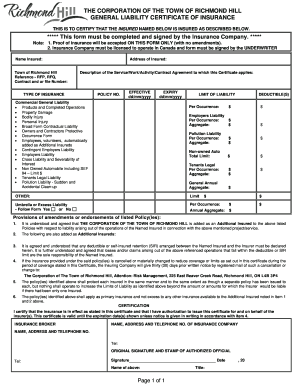

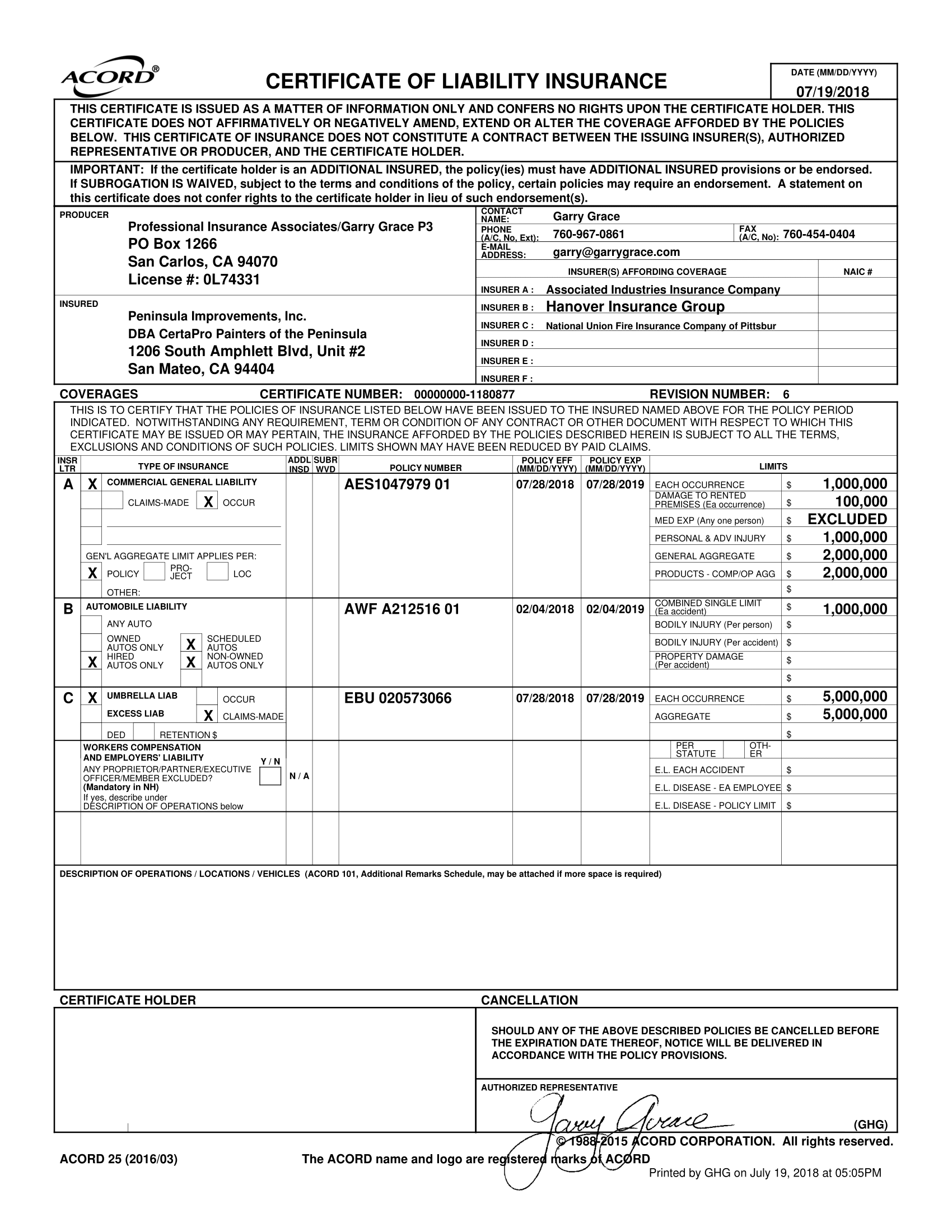

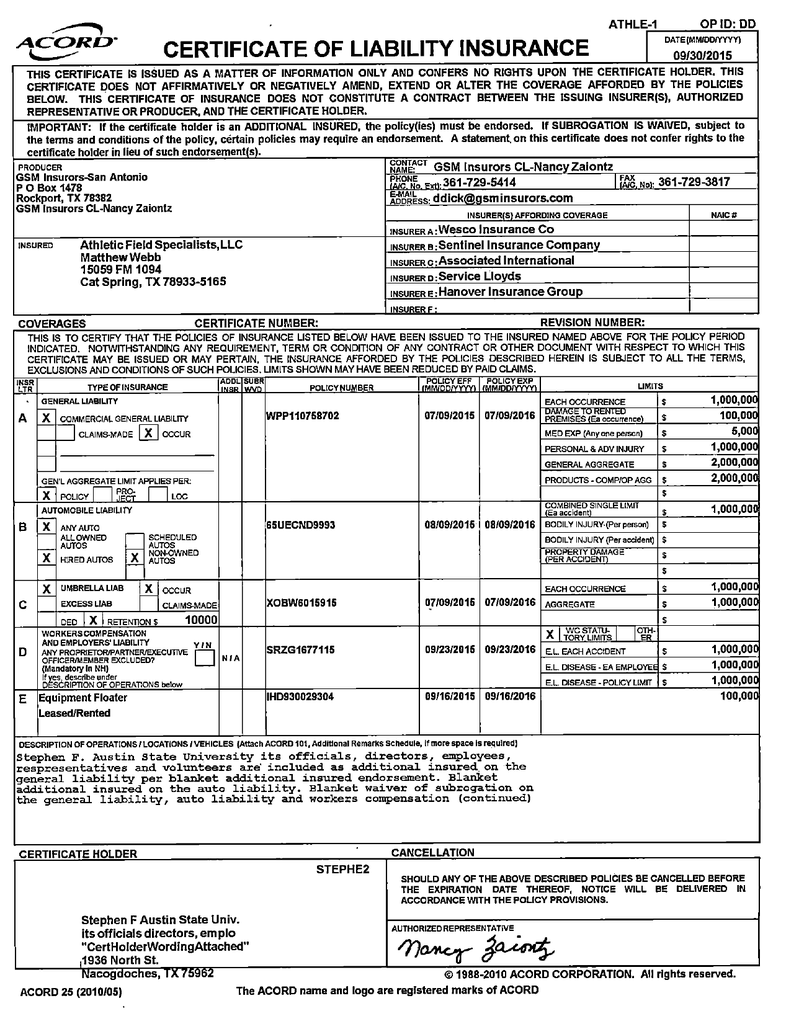

General liability certificate. If the certificate holder is an additional insured the policyies must be endorsed. The form is an easy read and print ready. Wait to receive your certificate. A certificate of insurance coi sometimes called a certificate of liability insurance is a one page document that summarizes your coverage and can be used as proof of insurance.

If youre wondering what is liability insurance well explain it. A certificate is not part of a policy. It is important to understand that employees fill general liability claims. Just follow these three easy steps.

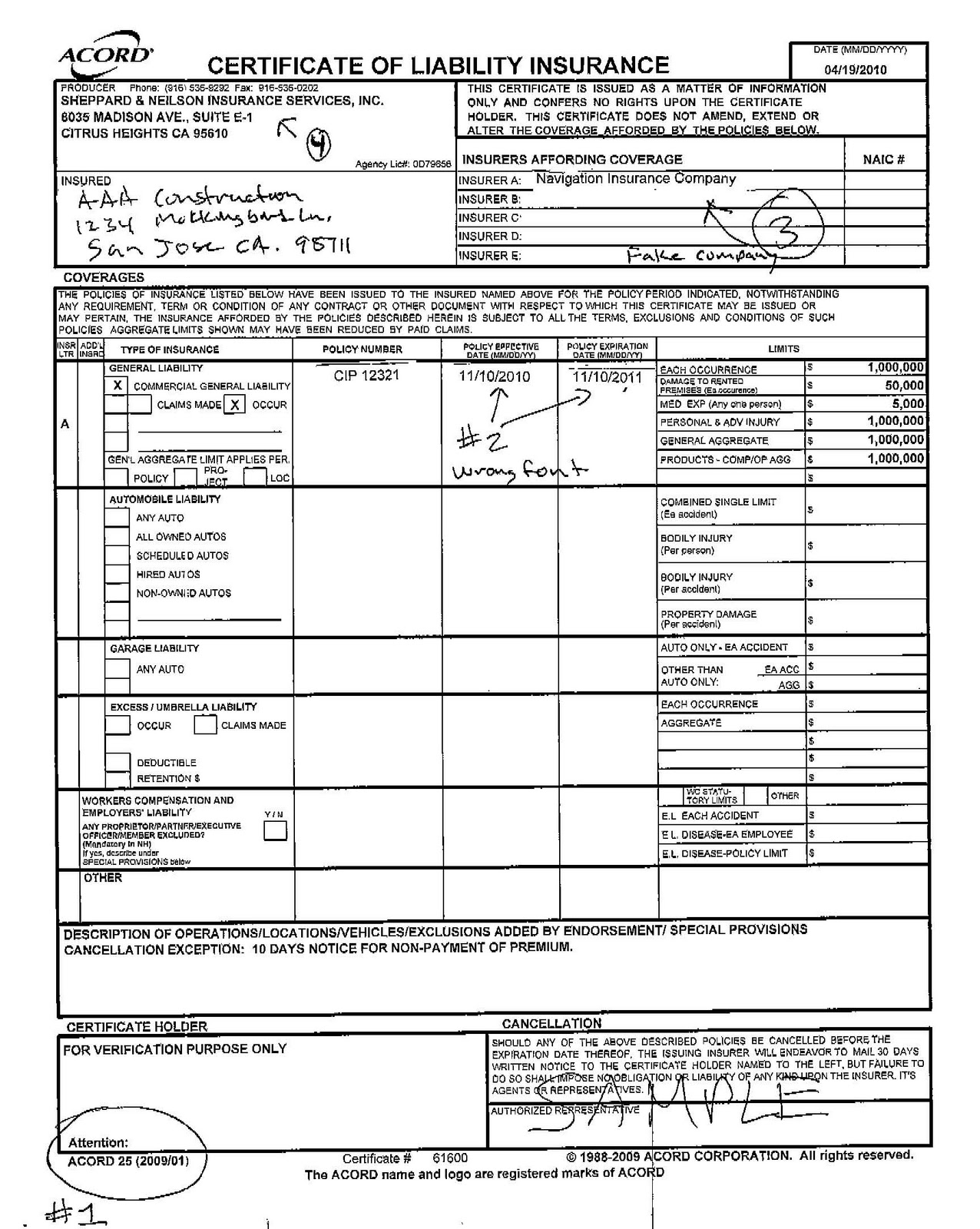

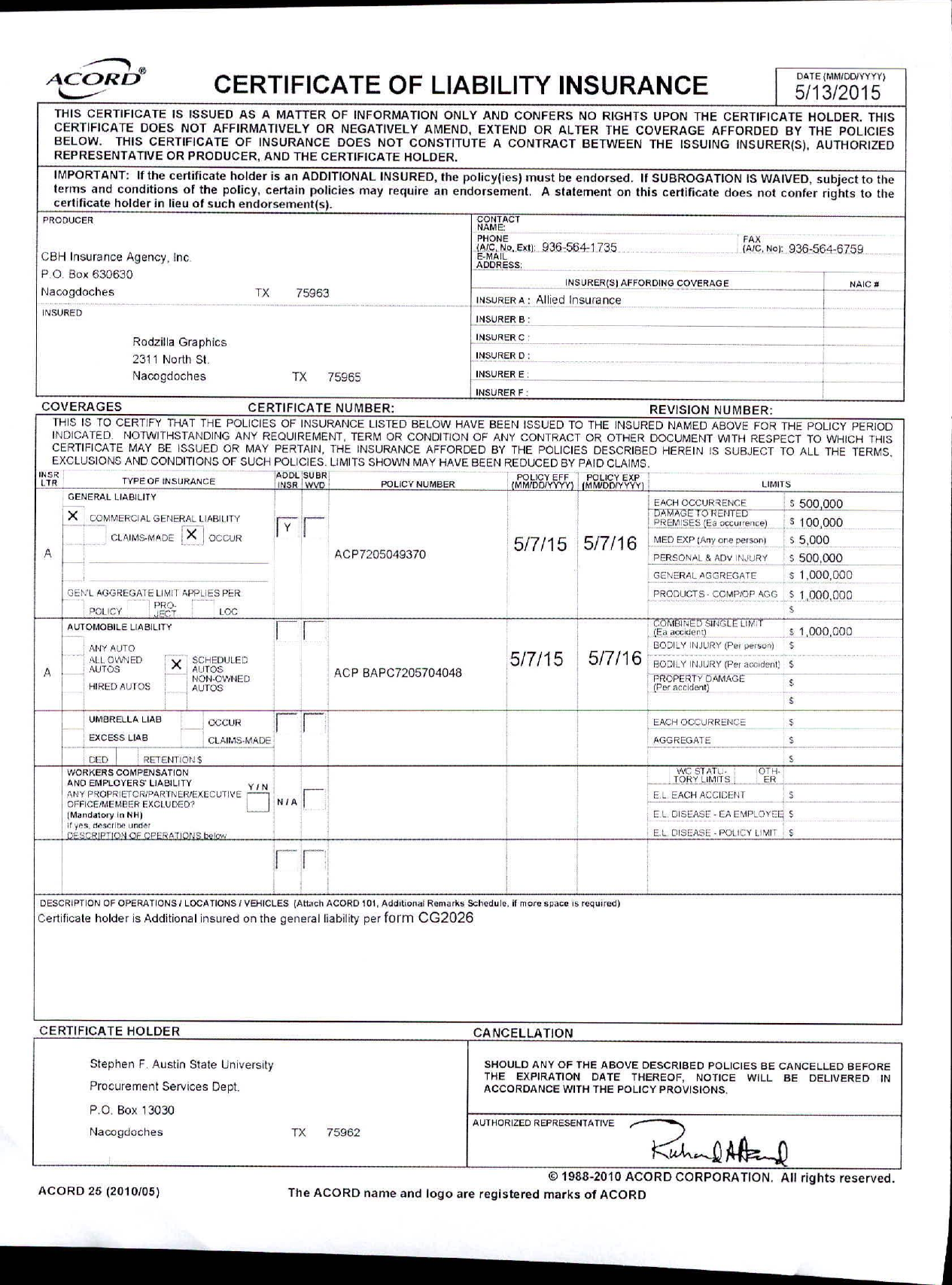

This certificate does not affirmatively or negatively amend extend or alter the coverage afforded by the policies below. It is simply a summary of a companys insurance coverages. Here are some situations where you might need a certificate of liability insurance. Also called business liability insurance or commercial general liability insurance cgl this coverage helps protect you from a number of claims related to normal business operations.

General liability insurance gl is known by many names. Request a certificate of general liability insurance either through your agent or online. A client requires it. The form includes policy details such as coverage limits and effective dates so business owners can find and share them easily without revealing other more private information.

General liability insurance is the business liability insurance that every business needs. A certificate of insurance serves as evidence of insurance coverage. It is most often requested as proof of liability insurance. This certificate is issued as a matter of information only and confers no rights upon the certificate holder.

In most cases we can process requests. Work with a representative to get the general liability insurance thats right for your business. Your landlord requires general liability insurance. Limits shown may have been reduced by paid claims.

If you apply for certain. Liability insurance means that it covers damages towards third parties only. It doesnt cover anything that happens to you your employees. It does not add remove or alter any provisions of the insurance contract.

If subrogation is waived subject to the terms and conditions of the policy certain policies may require an endorsement. Clients want to know that if you damage their property or cause them.