Can You Get Taxes Back From Receipts

Depending on the province or territory where you shop this tax will be called the goods services tax gst provincial sales tax pst or the harmonized sales tax hst.

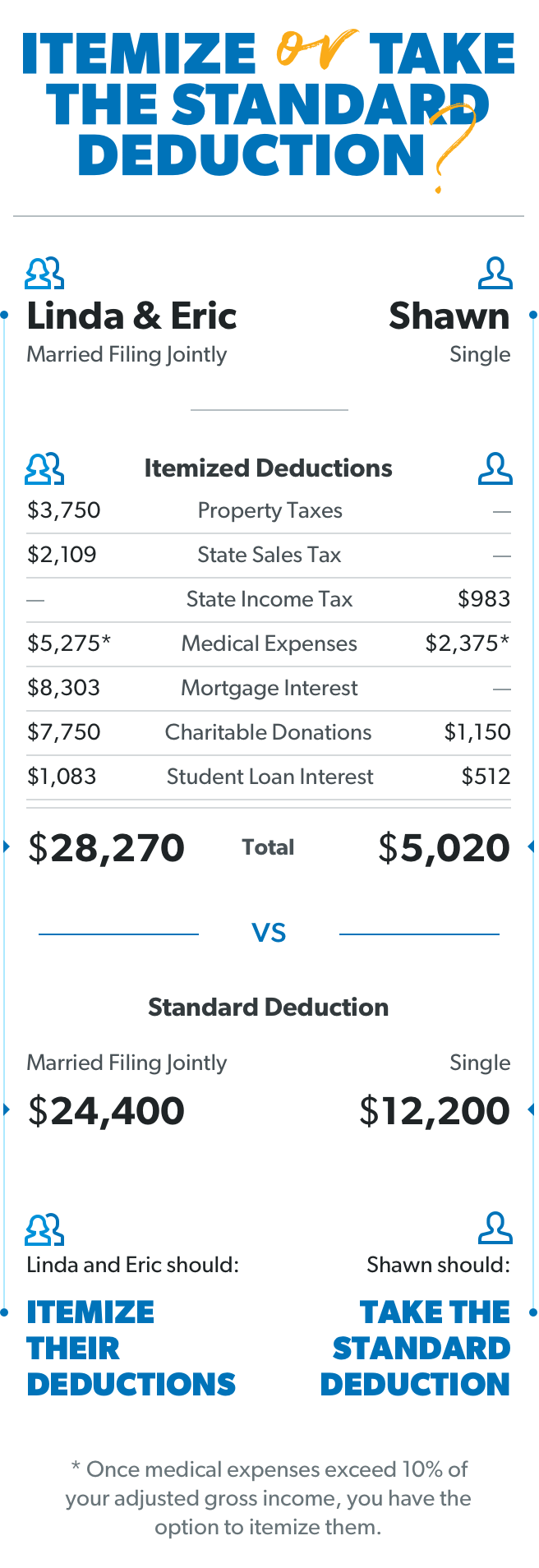

Can you get taxes back from receipts. However most of the time the irs sends a very personal note indicating the deduction was disallowed and requesting more money. Those deductions will not be available in tax year 2018. Whether you take the standard deduction or itemize deductions most people filing their 2018 taxes in 2019 will be happy they took the time to prepare when the irs deadline rolls around. Issue a check along with your invoice whichafter you have the invoice stamped at customsyou can redeem for cash directly at the tax free booth in the airport usually near customs or the duty free shop or you can mail it back to the store in the envelope provided within 60 days for your refund.

2009 was the last year for the sales tax option unless it is extended. Everyone can claim groceries on their taxes. Generally you can only deduct the total amount of these costs that exceed 2 percent of your adjusted gross income. 1 2020 applicants can submit copies of relevant receipts dated from july 1 2019 to the last day of december 2019.

There are some situations where groceries could become a legitimate expense. If you choose sales tax you can either add up the sales tax on all your receipts or use a standard table based on state income and family size. This refund process went into effect in july 2019 so beginning jan. This doesnt mean the irs will accept it immediately.

The minimum refund request amount is 25 in sales tax and you can only request one refund per calendar year. For some it is beneficial to deduct your state and local sales tax on your itemized deductions rather than the amount of state and local income taxes you had withheld from your paycheck. Gathering and saving receipts and tax documents is an important part of filing taxes. I once heard that if you keep your receipts of things you purchased from a store or anything else.

The amount varies from 5 to 15 percent of your purchase. Maintain all records and receipts for 5 years from the date you lodge your return. The government of canada no longer rebates the gst or hst to american consumers. You can claim them through the irs and possibly get more money back from them.

However if you claim over 300 you need proper substantiation for all of the amount including the first 300.