California Cpa Certificate

The california board of accountancy makes it easy for you to receive a reciprocal cpa license in the state if you hold a cpa certificate or license from another state.

California cpa certificate. Certificate of attest experience public accounting attest non public accounting attest certificate of general experience public accounting general non public accounting general certificate of experience in academia. License renewal and continuing education. Accounting in a state other than california. More firm licensee information.

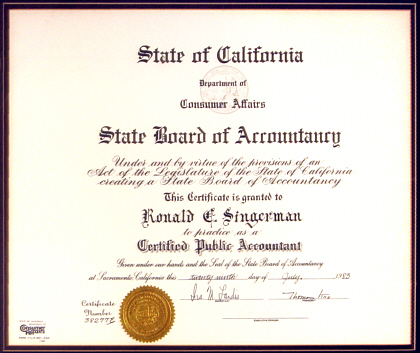

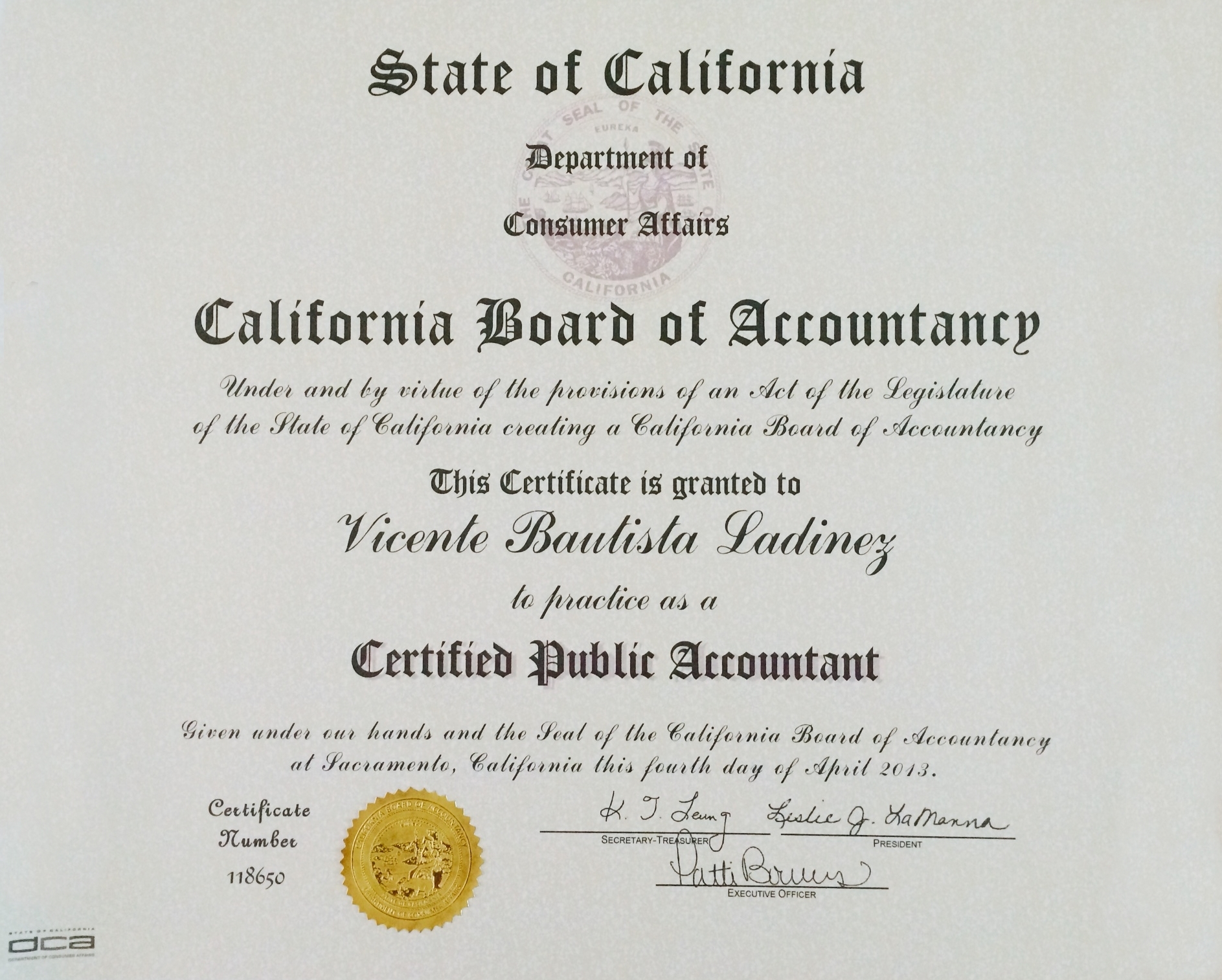

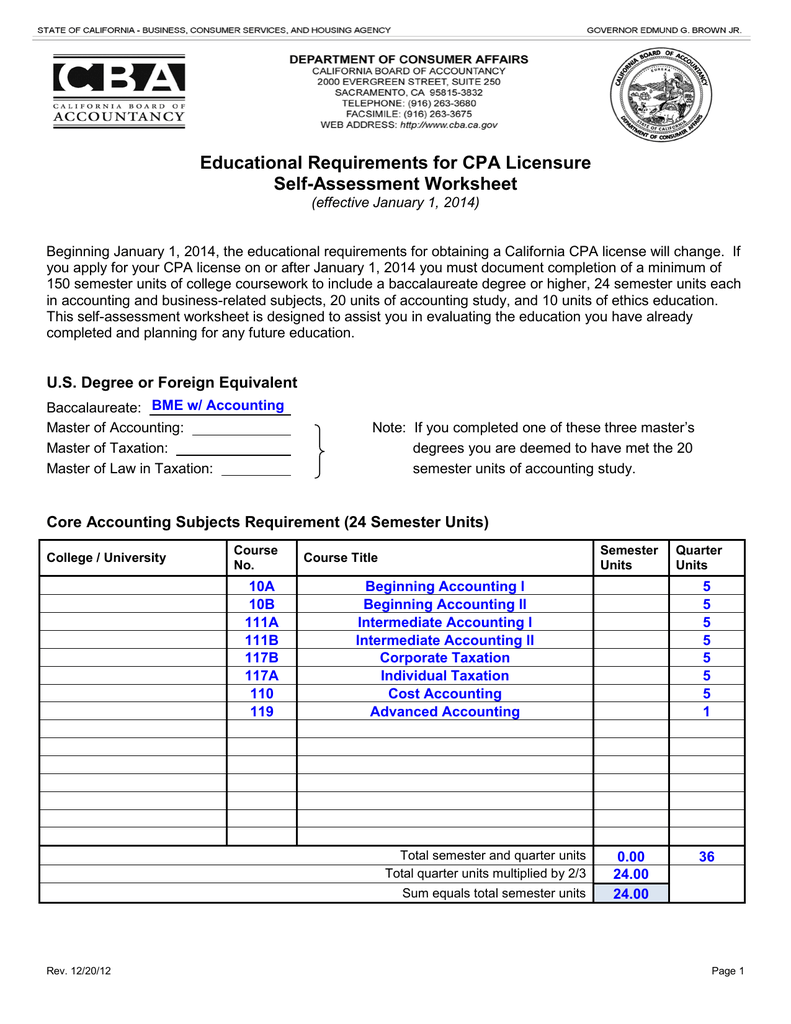

In california to earn the prestige associated with the cpa license individuals are required to demonstrate their knowledge and competence by passing the uniform cpa exam meeting high educational standards and completing a specified amount of general accounting experience. Type d an applicant who. Practice privilege reporting requirements. Requirements for the certificate is 54 units.

More out of state licensee. Previously was licensed as a cpa in california. Welcome to the california board of accountancy cba mission vision statement. Get answers to licensing questions.

More information about certificate program in accounting. The application for certified public accountant license form has sections for those who hold a cpa license in another state. Schools in california offer a variety of accounting certificate programs ranging from undergraduate programs to professional programs that prepare students to take the states certified public. A cpa is a certified public accountant and is licensed by the state.

Department of consumer affairs. To protect consumers by ensuring only qualified licensees practice public accountancy in accordance with established professional standards. And the certificate was cancelled after five years for nonpayment of license renewal fees. More cpa licensee information.

Request for licensing application packet. Type e an applicant who. Occupations that this certificate program prepares students to enter the positions like accountant budget analyst tax examiners and collectors and revenue agents and tax preparers. The california society of cpas supports the cpa profession with advocacy community top quality cpe and free ethics.