3c Certificate Exemption

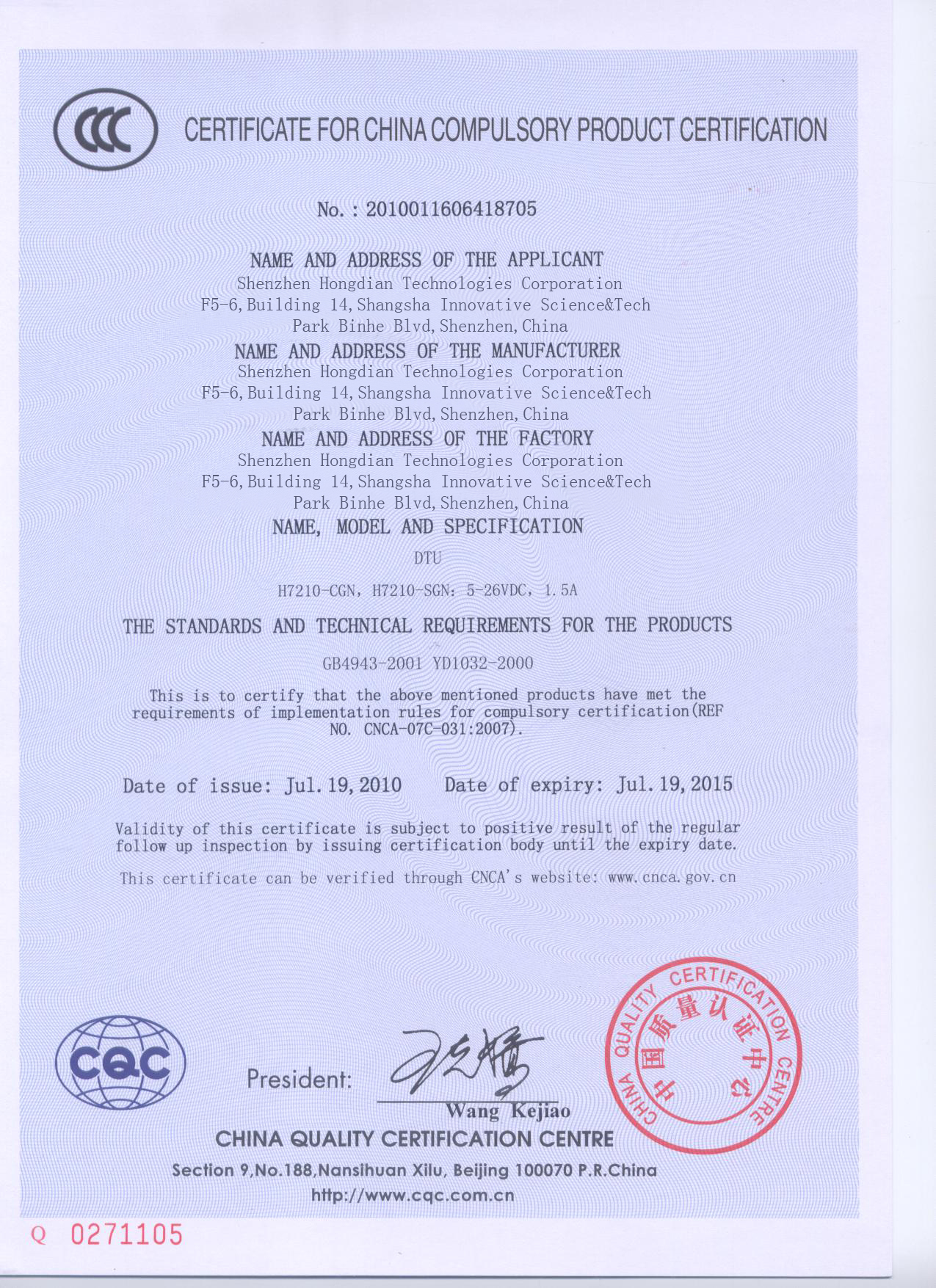

In order to avoid delays in delivery a ccc certification instead of a ccc exemption is recommendable.

3c certificate exemption. China compulsory certification ccc exemption the china compulsory certification ccc applies to 132 broad product groups especially automotive parts electronic products and it products. Ciq will also provide you or your agent a ciq declaration which proves that no ccc marking is required. The application for an exemption is managed by the importer and submitted to the local ciq office directly. Copy of incoming material manual formal invoice and packing slip.

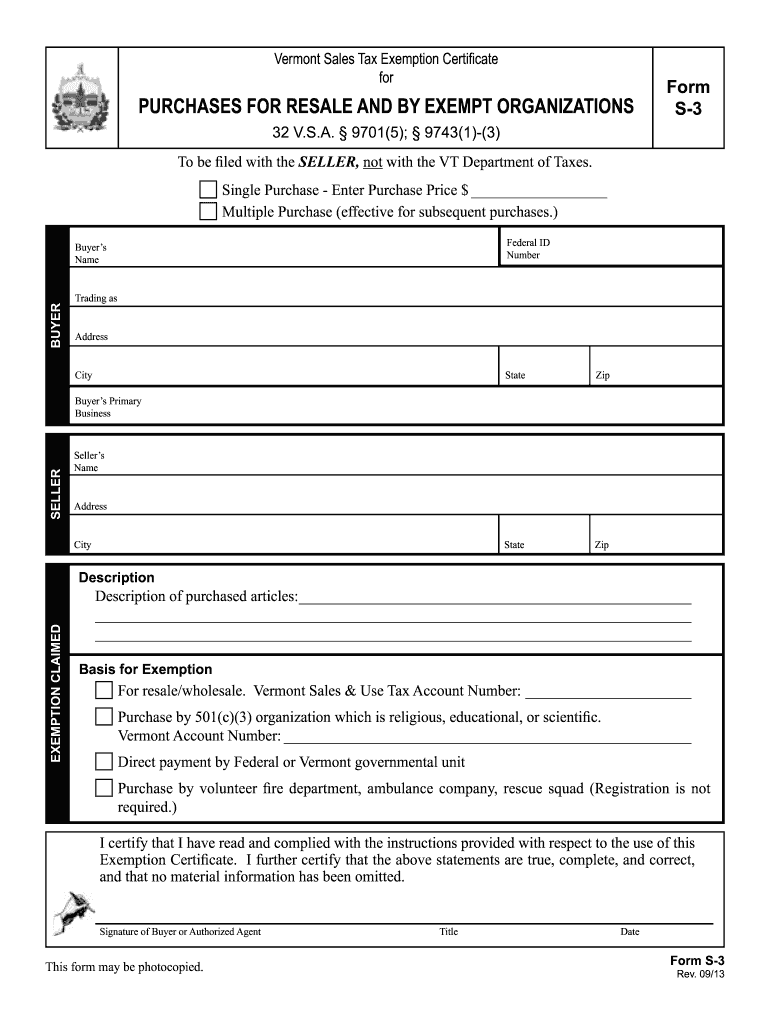

Brief introduction detailed office address phone number and fax of the applicant 4. Form s 3c vermont sales tax exemption certificate for contractors completing a qualified exempt project. For products to be exempted from 3c certifications manufacturers or agents shall apply to the certification and accreditation administration of the peoples republic of china and submit exempt proof material liability guarantees compliance statement including the test report forms etc for approval. If the buyer presents a multiple purchase exemption certificate to the seller it may be used only when purchasing tangible personal property for use as indicated on the exemption certificate.

While a few years ago an exemption for goods for building a production site was still possible this is almost impossible as of now. Many manufacturer ask for an exemption of the ccc certificate to avoid ccc certification. Copy of business license of applicant 3. Copy of domestic trade or foreign trade contract.

Documents can prove the product is qualified for the ccc waiver eg. 3c certificate the initials ccc also called china ccc certification as a mandatory product certification system strengthens the supervision of the products concerning health hygiene security environment and anti fraud with the aim to better protect consumers security. Another exemption that is seldom granted applies to production sites. For each purchase covered by the exemption certificate the sales slip or invoice must show the buyers name and address sufficient to link the purchase to the exemption certificate on file.

To be tax exempt under section 501c3 of the internal revenue code an organization must be organized and operated exclusively for exempt purposes set forth in section 501c3 and none of its earnings may inure to any private shareholder or individual. The applicable regulations must be examined so that there will not be any issue with customs clearance despite the exemption status.