10b5 1 Template

Providing a compliance approved plan template identifying an appropriate liquidity strategy executing the plan filing all required rule 144 forms with the sec on your behalf of the affiliate when necessary and.

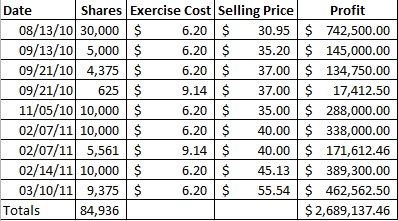

10b5 1 template. Your predetermined trading plan allows you to sell or buy company stock according to a schedule you establish up front even at times when other trading. Consistent with established best. The price amount and sales dates must be specified in advance and. Practices our services include.

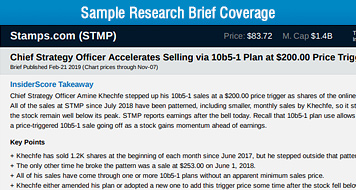

Due to the continual changes to section 16 practice resulting from sec staff interpretations and section 16b litigation companies and compliance personnel regularly are confronted with new challenges in keeping their advice and their compliance programs up to date. Rule 10b5 1 plans are back in the news. As one of the world s largest asset managers northern trust can help you incorporate the 10b5 1 rule into a comprehensive investment program that complements your overall financial plan and manages risk. In the world of insider trading rule 10b5 1 plans are a blessing and a curse.

Rule 10b5 1 allows company insiders to set up a predetermined plan to sell company stocks in accord with insider trading laws. A curse because they tempt cheaters into hiding their malfeasance in a cloak of invisibility. Sample rule 10b5 1 trading plan template. 10b5 1 trading plans for issuers and corporate insiders author.

Northern trust securities inc subject. This sales plan is entered into between seller and stifel for the purpose of establishing a trading plan that complies with the requirements of rule 10b5 1c1 under the securities exchange act of 1934 as amended the exchange act. In october of 2000 the sec amended and updated the securities exchange act of 1934 an act to prevent trading fraud in an effort to clarify the ambiguities of the existing insider trading rules. These plans are widely used by officers and directors of public companies to sell stock according to the parameters of the affirmative defense to illegal insider trading available under rule 10b5 1 which was adopted by the sec in 2000.

New 10b5 1 plan helps solve executives diversification problems.